Get easy-to-follow, expert stock market tips that can help you earn more.

📈 Click here for smart, reliable advice! ✨

Bank Nifty Weightage 2024: Complete Analysis & Insights

SHARE

Bank Nifty Weightage for 2024 holds significant implications for traders and investors in the financial market. This article provides a comprehensive analysis of Bank Nifty Weightage, shedding light on the basics, historical trends, methodology, impact on trading strategies, and much more.

Here are the key insights:

Basics of Bank Nifty Weightage

– Bank Nifty Weightage is a metric that measures the relative importance of individual stocks within the Bank Nifty index.

– It plays a crucial role in determining the performance of the Bank Nifty index as a whole.

– Understanding how this weightage is calculated is essential for anyone navigating the stock market.

Historical Trends in Bank Nifty Weightage

– Exploring the evolution of Bank Nifty Weightage over the years helps investors make informed decisions.

– Comparative analysis between 2023 and 2024 showcases the shifts in stock importance.

Methodology Behind Calculating Bank Nifty Weightage

– We provide a step-by-step guide to understanding how Bank Nifty Weightage is calculated.

– Market capitalization’s role in this calculation is explained in detail.

Impact on Trading Strategies

– Discover how traders incorporate Bank Nifty Weightage into their portfolio management strategies.

– Risk assessment and management based on weightage data are explored.

Tools and Resources for Analysis

– Top tools for analyzing Bank Nifty Weightage are highlighted.

– Learn how to utilize this data effectively for market analysis.

Future Predictions

– Experts’ predictions on Bank Nifty Weightage trends for the future are discussed.

– Economic factors that may influence Bank Nifty Weightage are examined.

What Are the Basics of Bank Nifty Weightage?

Bank Nifty Weightage is a fundamental concept in the world of finance, particularly for those interested in trading or investing in the Indian stock market. Understanding the basics of Bank Nifty Weightage is crucial to navigate this dynamic landscape effectively. Here, we break down the fundamentals:

Definition: Bank Nifty Weightage, often referred to as just “Weightage,” is a metric that measures the relative importance of individual stocks within the Bank Nifty index. It provides insight into how heavily certain stocks influence the overall performance of the Bank Nifty.

Stock Importance: The weightage assigned to each stock in the Bank Nifty index is not equal. Some stocks carry more significant weight due to their market capitalization and overall importance in the banking sector.

Calculation: Weightage is calculated based on the free-float market capitalization of each stock in the index. Essentially, stocks with higher market capitalization have a more substantial impact on the index’s movement.

Index Performance: Understanding the weightage is essential for investors as it indicates which stocks are driving the index’s performance. A change in the price of heavily weighted stocks can significantly impact the Bank Nifty.

Investment Strategy: Investors and traders often use Bank Nifty Weightage data to make informed decisions. A stock with high weightage may receive more attention in their portfolio strategies.

Defining Bank Nifty Weightage in the Financial Market

Definition: Bank Nifty Weightage is a key metric used in the financial market to measure the relative importance of individual stocks within the Bank Nifty index.

Market Influence: It plays a vital role in determining the overall performance of the Bank Nifty index by showcasing how specific stocks impact its movements.

Calculation: Weightage is calculated based on the market capitalization of each stock in the index, giving more weight to stocks with higher market capitalization.

Investor Insight: Investors and traders use this data to understand which stocks are driving the index’s performance, helping them make informed decisions.

Strategic Use: Bank Nifty Weightage data is essential for crafting investment strategies that align with the index’s composition and behavior, enhancing portfolio management.

Maximize Your Profits with Expert Calls!

Access expert stock calls for quick profits. Trade with confidence through BankNifty.today’s insights!

Key Factors Influencing Bank Nifty Weightage

Market Capitalization: The primary factor influencing Bank Nifty Weightage is the market capitalization of individual stocks. Stocks with higher market cap carry more weight in the index.

Stock Price Movements: Significant price movements in specific stocks can impact their weightage within the Bank Nifty. A surge in a heavily weighted stock can lift the entire index.

Corporate Actions: Events like stock splits, mergers, or bonus issues can affect the market capitalization and, subsequently, the weightage of stocks in the Bank Nifty.

New Listings: When a new stock enters the index, it can alter the weightage of existing constituents.

Index Rebalancing: Regular index rebalancing by stock exchanges ensures that the weightage accurately reflects the market’s dynamics.

Analyzing Historical Trends in Bank Nifty Weightage

Analyzing historical trends in Bank Nifty Weightage is crucial for investors and traders seeking insights into the index’s past behavior and potential future movements. Here, we delve into the significance of studying these trends:

Understanding Evolution: Historical trends reveal how Bank Nifty Weightage has evolved over the years. This knowledge is essential for gauging how the index has adapted to changing market dynamics.

Comparative Analysis: Comparing weightage data from different years, such as from 2023 to 2024, allows us to identify shifts in stock importance. This can provide valuable cues for investment decisions.

Identification of Patterns: Studying long-term patterns in weightage data can help investors recognize recurring trends, potentially aiding in predicting future market movements.

Risk Assessment: Historical trends also assist in assessing the risk associated with certain stocks. Stocks with consistent high weightage might be considered more stable, while those with volatile weightage can pose higher risks.

Portfolio Management: Investors can use historical weightage data to fine-tune their portfolio management strategies. It helps in deciding how much exposure to maintain in specific stocks.

In conclusion, historical trends in Bank Nifty Weightage offer a wealth of information for market participants. They provide insights into the index’s past performance, potential future directions, and risk assessment. Savvy investors use this data to make informed decisions and stay ahead in the ever-changing world of finance.

Decoding the Evolution of Bank Nifty Weightage Over Years

Analyzing historical trends in Bank Nifty Weightage is crucial for investors and traders seeking insights into the index’s past behavior and potential future movements. Here, we delve into the significance of studying these trends:

Understanding Evolution: Historical trends reveal how Bank Nifty Weightage has evolved over the years. This knowledge is essential for gauging how the index has adapted to changing market dynamics.

Comparative Analysis: Comparing weightage data from different years, such as from 2023 to 2024, allows us to identify shifts in stock importance. This can provide valuable cues for investment decisions.

Identification of Patterns: Studying long-term patterns in weightage data can help investors recognize recurring trends, potentially aiding in predicting future market movements.

Comparative Analysis: Bank Nifty Weightage Changes from 2023 to 2024

Year-to-Year Variations: Comparing Bank Nifty Weightage changes from 2023 to 2024 reveals significant shifts in the composition of the index.

Identifying Trends: This comparative analysis allows investors to identify trends in the market and understand which stocks have gained or lost prominence.

Impact on Strategies: Investors and traders can adjust their strategies based on these changes, optimizing their portfolios for the current market conditions.

Risk Assessment: Stocks with substantial weightage changes may carry higher risks or opportunities, depending on their performance and outlook.

Informed Decision-Making: Being aware of weightage variations empowers market participants to make more informed and timely investment decisions.

Get our Trading Tips for Free! 🎉

Sign up for our no-cost trial and see your trading improve.

Join our Telegram now!

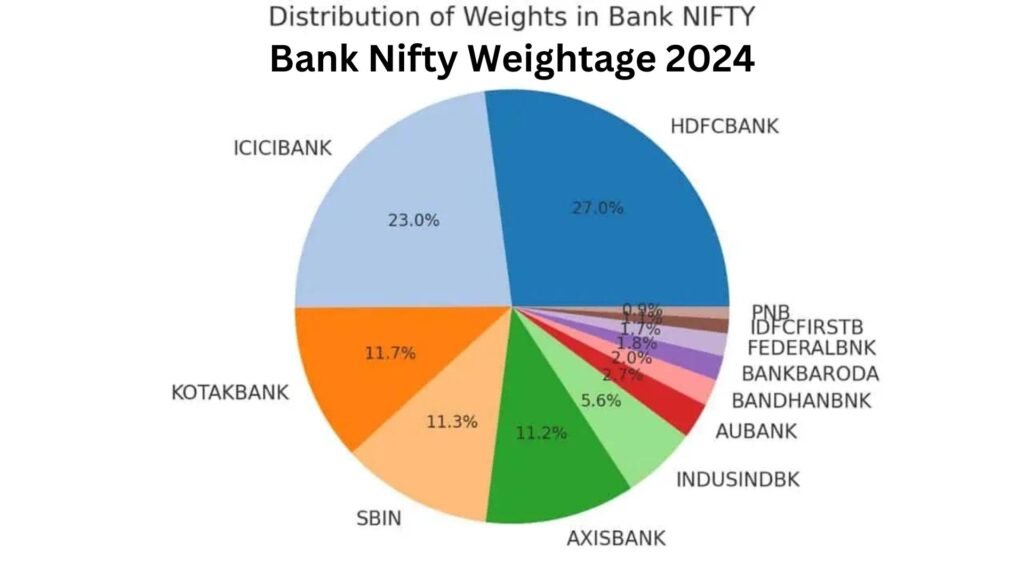

Comprehensive List of Bank Nifty Weightage Stocks for 2024

For traders and investors navigating the Indian financial markets, having access to the comprehensive list of Bank Nifty Weightage stocks for 2024 is paramount. Here, we provide you with a detailed overview of the stocks that make up this influential index:

HDFC Bank: As one of India’s largest private sector banks, HDFC Bank consistently holds a substantial weightage in Bank Nifty due to its significant market capitalization.

ICICI Bank: Another heavyweight in the banking sector, ICICI Bank, plays a pivotal role in the Bank Nifty index.

Kotak Mahindra Bank: Known for its robust financial services, Kotak Mahindra Bank is a prominent constituent of Bank Nifty.

Axis Bank: This leading private sector bank contributes significantly to the index’s performance, making it a key player.

State Bank of India (SBI): As India’s largest public sector bank, SBI’s weightage in Bank Nifty reflects its influence on the broader financial market.

Bajaj Finance: A non-banking financial company, Bajaj Finance, is renowned for its presence in the retail lending sector, making it a noteworthy inclusion.

Bajaj Finserv: The financial conglomerate, Bajaj Finserv, adds diversity to the index with its multiple financial service offerings.

HDFC: Housing Development Finance Corporation (HDFC) is a dominant player in the housing finance sector, contributing to Bank Nifty’s overall weightage.

Sector-Wise Breakdown of Bank Nifty Weightage Stocks

Understanding the sector-wise breakdown of Bank Nifty Weightage stocks is vital for investors and traders looking to diversify their portfolios. Here’s a concise overview:

Banking Sector Dominance: The majority of Bank Nifty Weightage stocks naturally belong to the banking sector, reflecting its significant influence on the index.

Financial Services: Financial services companies, including non-banking financial institutions, contribute to the diversity of the index.

Housing Finance: Housing finance companies also hold a notable position, indicating the importance of the real estate and housing sector.

Power and Infrastructure: Stocks from the power and infrastructure sectors play a role in the index’s composition, providing a broader market perspective.

Credit Cards and Payment Services: The inclusion of these companies showcases the evolving landscape of digital payments.

Top Movers: Significant Changes in Bank Nifty Weightage Stocks

Bank Nifty’s dynamic composition undergoes changes, and understanding the top movers – stocks with significant weightage changes – is crucial for investors. Here’s a snapshot of these key shifts:

HDFC Bank: Continues to be a top mover, reflecting its market dominance.

ICICI Bank: Its weightage fluctuations indicate its influence on Bank Nifty.

Kotak Mahindra Bank: Remains a notable stock with changing weightage.

Axis Bank: Its movements can sway the index, making it a top mover.

Bajaj Finance: Significant weightage changes highlight its impact on the index.

IDFC First Bank: This stock’s weightage shifts reflect its evolving role.

SBI Cards and Payment Services: Its inclusion showcases the growth of digital payments in India.

Monitoring these top movers provides valuable insights for investors adjusting their strategies in response to evolving market dynamics.

Methodology Behind Calculating Bank Nifty Weightage

Understanding the methodology behind calculating Bank Nifty Weightage is essential for traders and investors seeking to decode the index’s performance. Here, we unveil the step-by-step process:

Free-Float Market Capitalization: The cornerstone of Bank Nifty Weightage calculation is the free-float market capitalization of each stock in the index. This metric excludes locked-in shares and helps gauge the actual market value of a company.

Weight Factor: Each stock’s free-float market capitalization is multiplied by a weight factor, which represents its proportion in the index. This factor is typically a fraction of the total index free-float market capitalization.

Normalization: To maintain continuity when there are changes in the index, a normalization factor is applied. This ensures that the index value remains consistent despite corporate actions, like stock splits or bonuses.

Weightage Calculation: The final weightage of a stock is derived by dividing its weighted market capitalization by the sum of the weighted market capitalization of all stocks in the index.

Impact on the Index: Stocks with higher market capitalization and weightage exert more influence on the Bank Nifty’s movements. Changes in these stocks’ prices have a more significant impact on the index’s value.

Regular Updates: Stock exchanges regularly update the weightage calculations to reflect changes in stock prices and market capitalization.

Step-by-Step Guide to Bank Nifty Weightage Calculation

Bank Nifty Weightage calculation follows a systematic process that investors and traders should comprehend. Here’s a simplified step-by-step guide:

Step 1: Collect Stock Data: Gather data on the stocks included in Bank Nifty, including their market capitalization and free-float shares.

Step 2: Calculate Free-Float Market Cap: Determine the free-float market capitalization for each stock by multiplying its total market cap by the free-float factor.

Step 3: Assign Weight Factor: Apply a weight factor to each stock based on its free-float market cap’s proportion in the index’s total free-float market cap.

Step 4: Normalize Values: Normalize the weight factors to account for any changes due to corporate actions, maintaining index continuity.

Understanding the Role of Market Capitalization in Bank Nifty Weightage

Market capitalization plays a pivotal role in determining Bank Nifty Weightage, influencing the index’s composition and performance. Here’s why it’s crucial:

Market Value Reflection: Market capitalization reflects the total market value of a company’s outstanding shares. It serves as an indicator of a stock’s worth in the market.

Weightage Calculation: In Bank Nifty Weightage calculation, stocks with higher market capitalization carry more weight. This means their price movements have a more significant impact on the index.

Diverse Representation: Market capitalization ensures that larger and more influential companies have a greater say in the index’s performance, offering a diverse representation of the banking sector.

The Impact of Bank Nifty Weightage on Trading Strategies

Bank Nifty Weightage is not just a numerical figure but a critical factor that significantly influences trading strategies. Traders and investors must grasp how weightage impacts their decision-making process. Here’s why it matters:

Strategic Allocation: Understanding the weightage of individual stocks within the Bank Nifty index allows traders to strategically allocate their capital. Stocks with higher weightage may receive more attention in their portfolio.

Index Movement: Heavily weighted stocks have a more substantial impact on the Bank Nifty’s movements. Traders often focus on these stocks as their price changes can sway the entire index.

Risk Management: Weightage data aids in risk assessment and management. Stocks with high weightage changes may be perceived as riskier or offer unique opportunities, affecting risk management strategies.

Portfolio Optimization: Investors can optimize their portfolios based on the weightage of stocks within the index. This ensures alignment with the index’s composition and behavior.

Informed Decision-Making: Weightage data informs traders about the influence of specific stocks on the index, enabling them to make informed, data-driven decisions.

In conclusion, Bank Nifty Weightage is a crucial element in shaping trading strategies. It guides capital allocation, risk management, and portfolio optimization, making it a fundamental consideration for traders and investors in the dynamic world of finance.

Incorporating Bank Nifty Weightage in Portfolio Management

Incorporating Bank Nifty Weightage into portfolio management is a savvy move for investors seeking optimal returns and risk mitigation. Here’s how it can be done:

Strategic Allocation: Allocate capital proportionally to stocks based on their weightage in the Bank Nifty index.

Risk Diversification: Consider the weightage of individual stocks to ensure a diversified portfolio that aligns with the index’s composition.

Rebalancing: Regularly adjust the portfolio to mirror any changes in Bank Nifty Weightage to maintain alignment with market trends.

Performance Evaluation: Track the performance of the portfolio against the Bank Nifty index to gauge its effectiveness.

Risk Management: Utilize weightage data to assess and manage risks associated with specific stocks within the portfolio.

By incorporating Bank Nifty Weightage into portfolio management, investors can create a well-balanced and responsive investment strategy that aligns with the broader market’s dynamics.

Risk Assessment and Management Based on Bank Nifty Weightage

Bank Nifty Weightage data serves as a vital tool for risk assessment and management in the world of finance. Here’s how it plays a crucial role:

Risk Identification: High weightage stocks are more influential in the index’s movements, so understanding their performance is key to identifying potential risks.

Portfolio Adjustment: By considering weightage data, investors can make informed decisions to adjust their portfolio, reducing exposure to riskier assets.

Hedging Strategies: Investors may choose to hedge their positions in high weightage stocks to protect against adverse price movements.

Diversification: Weightage data guides diversification efforts, helping mitigate the risk associated with overconcentration in a particular stock or sector.

Tracking Market Sentiment: Monitoring weightage changes provides insights into market sentiment, allowing for proactive risk management decisions.

Tools and Resources for Bank Nifty Weightage Analysis

Analyzing Bank Nifty Weightage requires the right tools and resources to make informed decisions in the dynamic world of finance. Here’s a list of essential tools and resources:

Stock Screeners: Online stock screeners help identify stocks with significant weightage in Bank Nifty, allowing traders to focus on influential stocks.

Market Data Providers: Access to real-time market data from reliable providers helps investors stay updated on weightage changes.

Financial News Platforms: Financial news outlets offer valuable insights into stock movements and weightage alterations within the index.

Trading Platforms: Modern trading platforms often include tools for analyzing weightage data and its impact on trading strategies.

Charting Software: Technical analysis tools within charting software can help traders visualize weightage trends and their correlations with price movements.

Index Reports: Reports and publications from stock exchanges and financial institutions provide in-depth information on Bank Nifty Weightage.

Data Analytics: Advanced data analytics tools allow for deeper analysis of weightage data and its historical trends.

Educational Resources: Books, online courses, and seminars on financial markets can enhance understanding of Bank Nifty Weightage.

By leveraging these tools and resources, investors and traders can effectively analyze Bank Nifty Weightage, make informed decisions, and stay ahead in the ever-evolving world of finance.

Top Tools for Analyzing Bank Nifty Weightage

Analyzing Bank Nifty Weightage requires the right tools to navigate the intricate financial landscape effectively. Here are some top tools at your disposal:

Stock Screeners: Online stock screeners help identify Bank Nifty constituent stocks and their weightage within the index.

Financial News Platforms: Financial news outlets offer real-time updates on weightage changes, aiding in timely decision-making.

Market Data Providers: Reliable data providers offer comprehensive information on market capitalization and weightage data for each stock in Bank Nifty.

Technical Analysis Software: Advanced charting and technical analysis tools assist in visualizing weightage trends and their impact on trading strategies.

Index Reports: Reports from stock exchanges and financial institutions provide detailed insights into Bank Nifty Weightage.

How to Utilize Bank Nifty Weightage Data for Market Analysis

Bank Nifty Weightage data is a valuable resource for market analysis, offering insights that can inform trading decisions and portfolio management. Here’s how to effectively utilize this data:

Identify Influential Stocks: Determine which stocks carry the highest weightage within Bank Nifty, as they have the most significant impact on the index’s movements.

Trend Analysis: Monitor changes in weightage over time to identify trends and potential shifts in market sentiment.

Diversification: Use weightage data to ensure your portfolio aligns with the index’s composition, helping to diversify risk.

Risk Management: Be aware of stocks with significant weightage changes, as they may carry higher risks or opportunities

Trading Strategies: Incorporate weightage data into your trading strategies, focusing on influential stocks for potential trading opportunities.

Case Studies: Success and Failure in Bank Nifty Weightage

Examining case studies of success and failure in Bank Nifty Weightage offers valuable insights into how weightage can impact investment outcomes. Here, we explore both sides of the coin:

Success Stories:

HDFC Bank’s Dominance: HDFC Bank’s consistently high weightage in Bank Nifty has rewarded investors. Its stability and growth have contributed positively to portfolios, making it a success story for long-term investors.

Adaptability of Kotak Mahindra Bank: Kotak Mahindra Bank’s ability to adapt and maintain a substantial weightage has been instrumental in its success. It shows that banks can evolve and stay relevant in the index.

Strategic Moves by Bajaj Finance: Bajaj Finance’s strategic growth and increasing weightage in the index have reflected its success. Its performance has drawn investors seeking exposure to the non-banking financial sector.

Failure Stories:

Decline of Yes Bank: Yes Bank’s weightage plummeted due to financial troubles. Investors who failed to monitor these changes faced significant losses.

Volatile Journey of IndusInd Bank: IndusInd Bank’s weightage fluctuations demonstrate the challenges it faced. Investors not adapting to this volatility may have struggled.

Short-lived Prominence of IDFC First Bank: IDFC First Bank’s initial rise in weightage was followed by a decline. Investors who didn’t react promptly may have faced setbacks.

Success Stories: Winning Strategies Using Bank Nifty Weightage

Bank Nifty Weightage has played a pivotal role in shaping winning investment strategies for many. Here are some success stories:

HDFC Bank’s Consistency: Investors who have consistently held HDFC Bank, with its high weightage, in their portfolios have enjoyed long-term success due to its stability and growth.

Kotak Mahindra Bank’s Resilience: Traders who recognized Kotak Mahindra Bank’s adaptability and its ability to maintain a substantial weightage have reaped rewards as the bank evolved.

Bajaj Finance’s Strategic Growth: Those who strategically invested in Bajaj Finance, capitalizing on its increasing weightage, have seen success, benefiting from its strong performance in the non-banking financial sector.

Learning from Past Mistakes: Bank Nifty Weightage Blunders

Learning from past mistakes in dealing with Bank Nifty Weightage is crucial for investors. Here are some blunders that offer valuable lessons:

Yes Bank’s Decline: Ignoring the plummeting weightage of Yes Bank due to financial troubles led to significant losses for some investors.

IndusInd Bank’s Volatility: Failing to adapt to the weightage fluctuations of IndusInd Bank resulted in challenges for those who did not monitor the bank’s performance closely.

IDFC First Bank’s Short-lived Prominence: Investors who didn’t respond promptly to IDFC First Bank’s initial rise in weightage faced setbacks when it declined.

These blunders emphasize the importance of vigilance, adaptability, and proactive decision-making when dealing with Bank Nifty Weightage to avoid potential pitfalls.

Future Predictions: Where is Bank Nifty Weightage Heading?

Predicting the future trajectory of Bank Nifty Weightage is a topic of great interest for traders, investors, and market analysts. While no one can offer definitive forecasts, several factors provide insight into where Bank Nifty Weightage might be heading:

Market Capitalization Trends: Tracking market capitalization changes of individual stocks within Bank Nifty can offer clues about potential weightage shifts. Stocks with rapid market cap growth may garner higher weightage.

Economic Conditions: Broader economic factors, such as GDP growth, inflation rates, and government policies, can influence the banking sector’s performance and, consequently, weightage changes.

Corporate Actions: Events like mergers, acquisitions, or public offerings can impact the market cap and weightage of specific stocks.

Sectoral Developments: The performance of sectors like banking, financial services, and non-banking financial companies (NBFCs) can influence weightage dynamics, especially if one sector experiences significant growth.

Global Market Trends: International market trends and global economic conditions can indirectly affect Bank Nifty Weightage through foreign investments and trade dynamics.

Regulatory Changes: Regulatory decisions, such as changes in listing requirements or foreign investment limits, can impact the composition of Bank Nifty.

While these factors provide a framework for future predictions, it’s important to note that weightage changes can be unpredictable and influenced by a complex interplay of variables.

Market Expert Predictions on Bank Nifty Weightage Trends

Market experts often provide valuable insights into Bank Nifty Weightage trends. Here are some key predictions and viewpoints from experts:

Analyst Forecasts: Financial analysts frequently offer forecasts on how individual stocks’ weightage might change based on performance and market dynamics.

Sectoral Focus: Experts often highlight the sectors likely to influence Bank Nifty Weightage in the near future, allowing investors to position themselves strategically.

Economic Indicators: Insights on how economic indicators, such as GDP growth, inflation rates, and interest rates, might impact the banking sector and, by extension, weightage trends.

Global Factors: Market experts consider global events and trends, such as trade relations and geopolitical issues, which can have ripple effects on Bank Nifty Weightage.

Economic Factors Affecting Future Bank Nifty Weightage

Several economic factors significantly impact the future of Bank Nifty Weightage. Here’s an overview:

GDP Growth: Economic growth directly affects the performance of banks and financial institutions, influencing their market capitalization and weightage in the index.

Interest Rates: Changes in interest rates can impact lending and borrowing activities, which in turn affect the banking sector’s profitability and weightage.

Inflation: High inflation can erode purchasing power, potentially affecting consumer spending and loan defaults, which can impact bank stocks’ performance.

Government Policies: Government fiscal and monetary policies, such as taxation and regulation, can directly impact the banking sector’s operations and, subsequently, its weightage in Bank Nifty.

Comparing Bank Nifty Weightage with Other Indices

Sectoral Focus: Bank Nifty primarily represents the banking and financial sector, while Nifty 50 is more diversified across various industries.

High Banking Exposure: Bank Nifty has a higher concentration of banking stocks, making it particularly sensitive to the performance of this sector.

Market Capitalization: Nifty 50 includes larger companies from various sectors, often with higher market capitalization, whereas Bank Nifty consists of banks and financial institutions with varying market caps.

Global Perspective: How Bank Nifty Weightage Stands Internationally

Comparison with Global Indices: Bank Nifty Weightage differs from global indices like the S&P 500 or FTSE 100, which reflect the compositions and dynamics of international markets.

Regional Impact: Bank Nifty Weightage is specific to the Indian market and is influenced by domestic economic factors, regulations, and market dynamics.

Bank Nifty vs. Nifty 50: Weightage Analysis

Comparing Bank Nifty and Nifty 50 through a weightage analysis provides valuable insights into their composition and relevance within the Indian financial market:

Sectoral Focus: Bank Nifty primarily comprises banking and financial sector stocks, while Nifty 50 encompasses a broader range of industries.

Concentration: Bank Nifty has a more concentrated focus on banking stocks, making it sensitive to the sector’s performance.

Market Capitalization: Nifty 50 typically includes larger companies across various sectors, often with higher market capitalization, while Bank Nifty represents financial institutions with diverse market caps.

Economic Significance: Both indices hold significance in India’s economic landscape, but Bank Nifty’s performance is closely tied to the banking and financial sector’s health.

Diversification: Nifty 50 offers more diversification, reducing risks associated with sector-specific fluctuations.

Global Perspective: How Bank Nifty Weightage Stands Internationally

Bank Nifty Weightage offers a unique perspective when viewed from a global context:

Domestic Focus: Bank Nifty is specific to the Indian financial market, reflecting the dynamics of the domestic banking and financial sector.

Emerging Market Relevance: India, an emerging market, showcases its distinctive financial landscape through Bank Nifty Weightage, attracting investors interested in emerging market opportunities.

Differing Compositions: Bank Nifty differs significantly from global indices like the S&P 500 or FTSE 100, which comprise a broader spectrum of industries and sectors.

Local Economic Impact: Bank Nifty Weightage is influenced by domestic economic factors, government policies, and regional regulations, making it unique compared to international benchmarks.

Educational Corner: Learning More about Bank Nifty Weightage

The educational corner is a space where investors and traders can enhance their understanding of Bank Nifty Weightage. Here are some valuable resources and avenues for learning:

1. Webinars and Workshops:

Webinars and workshops conducted by financial experts offer in-depth insights into Bank Nifty Weightage analysis, its impact on trading, and strategies for leveraging this information effectively.

2. Recommended Reading: Books and Journals:

Various books, research papers, and financial journals delve into the intricacies of Bank Nifty Weightage, providing comprehensive knowledge and real-world case studies.

3. Online Courses:

Numerous online courses, both free and paid, are available to help individuals master the art of Bank Nifty Weightage analysis and its application in trading and investment strategies.

4. Expert Interviews:

Interviews with market analysts and traders who have successfully navigated Bank Nifty Weightage can offer valuable insights and practical tips.

5. Trader Experiences:

Learning from the experiences of fellow traders who have integrated Bank Nifty Weightage into their strategies can provide practical and relatable insights.

By exploring these educational resources, investors and traders can deepen their understanding of Bank Nifty Weightage, refine their strategies, and make more informed decisions in the dynamic world of finance. Education is key to successfully utilizing weightage data for optimizing trading and investment portfolios.

Webinars and Workshops on Bank Nifty Weightage

Webinars and workshops focused on Bank Nifty Weightage offer valuable learning opportunities for investors and traders seeking to enhance their financial knowledge. Here’s what you can expect:

Expert Insights: Webinars feature expert speakers who provide in-depth insights into Bank Nifty Weightage analysis, its implications, and practical applications.

Interactive Learning: Workshops often involve hands-on activities, allowing participants to apply weightage concepts in real-time scenarios.

Q&A Sessions: Both webinars and workshops typically include Q&A sessions, enabling attendees to clarify doubts and gain a deeper understanding.

Case Studies: Real-world case studies are often presented to illustrate how weightage data impacts trading decisions and portfolio management.

Networking: These events provide opportunities to connect with like-minded individuals, share experiences, and expand professional networks.

Recommended Reading: Books and Journals on Bank Nifty Weightage

For those looking to dive deep into the world of Bank Nifty Weightage, here’s a curated list of recommended reading materials:

Books:

“Bank Nifty: Profitable Hedging Strategies” by Mr. Raghunath Reddy.

“Understanding Bank Nifty Index: Know The Pulse Of Banking Sector” by Mr. R. K. Tiwari.

Journals:

“International Journal of Banking, Risk, and Finance” – A scholarly journal featuring research on banking and financial markets, including weightage analysis.

“Indian Journal of Finance and Banking” – Provides insights into the Indian banking sector, including studies on Bank Nifty Weightage.

These resources offer comprehensive information, analyses, and research on Bank Nifty Weightage, helping investors and traders stay well-informed and make better financial decisions in the Indian market.

Frequently Asked Questions About Bank Nifty Weightage

Navigating the intricacies of Bank Nifty Weightage often prompts questions. Here’s a collection of frequently asked questions (FAQs) to shed light on this crucial aspect of financial markets:

1. What is Bank Nifty Weightage?

Bank Nifty Weightage refers to the relative importance of individual stocks within the Bank Nifty index, based on their market capitalization.

2. How is Bank Nifty Weightage Calculated?

Bank Nifty Weightage is calculated by assigning a weight factor to each stock in the index, derived from its free-float market capitalization.

3. Why is Bank Nifty Weightage Important?

It helps investors and traders understand the influence of specific stocks on the index’s performance, enabling informed decision-making.

4. Which Stocks Carry the Most Weightage in Bank Nifty?

Stocks like HDFC Bank, ICICI Bank, and Kotak Mahindra Bank typically carry substantial weightage due to their large market capitalization.

5. How Often is Bank Nifty Weightage Updated?

Stock exchanges regularly update Bank Nifty Weightage to reflect changes in stock prices and market capitalization.

6. Can Changes in Bank Nifty Weightage Impact My Portfolio?

Yes, significant weightage changes can affect your portfolio’s performance, especially if you hold stocks with substantial weightage in the index.

7. How Can I Use Bank Nifty Weightage for My Investment Strategy?

Investors can align their portfolios with Bank Nifty Weightage to diversify risk and make strategic investment decisions.

Common Queries and Expert Answers on Bank Nifty Weightage

Q1: What role does Bank Nifty Weightage play in my portfolio?

A1: Bank Nifty Weightage helps you diversify your portfolio effectively and align it with the index’s performance, reducing risk.

Q2: How frequently does Bank Nifty Weightage change?

A2: Weightage changes occur regularly, reflecting shifts in stock prices and market capitalization. They are typically updated by stock exchanges.

Q3: Can I use Bank Nifty Weightage data for short-term trading?

A3: Yes, weightage data can inform short-term trading decisions, as it highlights influential stocks in the index.

Q4: Are there any risks associated with relying on Bank Nifty Weightage for investment decisions?

A4: Overreliance on weightage data without considering other factors can lead to skewed decisions. It’s crucial to balance it with comprehensive analysis.

Myths vs. Facts: Clearing Misconceptions About Bank Nifty Weightage

Bank Nifty Weightage is often shrouded in myths and misconceptions. Let’s separate fact from fiction:

Myth: Bank Nifty Weightage reflects stock performance.

Fact: It’s based on market capitalization, not performance. Stocks with higher market caps carry more weightage.

Myth: Weightage changes always indicate stock price movement.

Fact: Weightage changes can be influenced by stock price or market cap fluctuations, but not always.

Myth: Weightage changes are infrequent.

Fact: They occur regularly due to market dynamics, impacting index composition.

Myth: A high-weight stock guarantees profits.

Fact: High weightage doesn’t guarantee returns; stock performance depends on various factors.

Myth: Weightage data alone suffices for investment decisions.

Fact: Comprehensive analysis, including fundamental and technical factors, is essential.

Expert Interviews: Insights into Bank Nifty Weightage

Gaining insights into Bank Nifty Weightage through expert interviews can be invaluable for investors and traders. Here’s a glimpse into the wisdom shared by market analysts and professionals:

1. Understanding Weightage Dynamics:

Experts emphasize the importance of comprehending how weightage is calculated and its impact on the index.

2. Sectoral Analysis:

Analysts often discuss the influence of specific sectors on Bank Nifty Weightage, offering sectoral insights.

3. Risk Management:

Experts provide strategies for managing risks associated with weightage changes, highlighting the need for diversification.

4. Investment Strategies:

Professionals share their approaches to aligning portfolios with Bank Nifty Weightage, optimizing returns.

5. Market Sentiment:

Interviews reveal how weightage can reflect market sentiment and act as a barometer for economic conditions.

6. Trading Tips:

Seasoned traders offer tips on leveraging weightage data for short-term trading, emphasizing the importance of timing.

7. Staying Informed:

Experts stress the need to stay updated on weightage changes and how they affect individual stock performance.

These expert interviews offer a wealth of knowledge for those seeking to navigate the Indian financial market effectively, providing practical insights and actionable strategies for leveraging Bank Nifty Weightage to their advantage.

Conversations with Market Analysts on Bank Nifty Weightage

Engaging in conversations with market analysts provides valuable perspectives on Bank Nifty Weightage:

Weightage Analysis: Analysts discuss how weightage influences the index’s movement and its implications for traders and investors.

Sector Insights: Conversations delve into the role of specific sectors in Bank Nifty Weightage, offering sectoral trends and predictions.

Risk Assessment: Analysts share their views on risk assessment and management strategies based on weightage changes.

Trading Strategies: Market analysts reveal trading strategies that align with weightage dynamics, optimizing profit potential.

Economic Impact: Analysts connect weightage trends to broader economic factors, providing a holistic understanding.

Timely Updates: Conversations help individuals stay updated on weightage shifts and their significance in real-time.

Trader Experiences: How Bank Nifty Weightage Influences Decisions

Trader experiences shed light on the practical implications of Bank Nifty Weightage in their decision-making process:

Informed Trading: Traders share how they use weightage data to make informed trading decisions, focusing on stocks with high weightage for potential opportunities.

Risk Management: Trader experiences often highlight the importance of managing risk, especially when dealing with stocks carrying substantial weightage.

Portfolio Optimization: Successful traders discuss how aligning their portfolios with Bank Nifty Weightage has helped them achieve better diversification.

Market Sentiment: Trader experiences reveal how weightage changes can reflect market sentiment, providing insights into investor behavior.

Adaptability: Seasoned traders emphasize the need to adapt strategies based on evolving weightage dynamics to stay competitive.

Technical Analysis: Deep Dive into Bank Nifty Weightage Charts

Delving into technical analysis through Bank Nifty Weightage charts is a powerful tool for investors and traders seeking to gain a competitive edge. Here’s a closer look at how this approach works:

1. Identifying Trends:

Chart Patterns: Analyzing Bank Nifty Weightage charts allows traders to identify trend patterns, such as uptrends, downtrends, or consolidations.

Support and Resistance: Charts reveal crucial support and resistance levels, aiding in entry and exit decisions.

2. Oscillators and Indicators:

Relative Strength Index (RSI): RSI readings on Bank Nifty Weightage charts help gauge overbought or oversold conditions, indicating potential reversal points.

Moving Averages: Moving averages plotted on the charts offer insights into trend direction and potential crossovers.

3. Volume Analysis:

Volume Bars: Studying volume bars in conjunction with weightage charts can provide clues about the strength of a trend or potential reversals.

4. Chart Patterns:

Head and Shoulders, Flags, Pennants: Recognizing these patterns on Bank Nifty Weightage charts helps traders anticipate future price movements.

5. Timeframes:

Multiple Timeframes: Analyzing weightage charts on various timeframes allows traders to align their strategies with short-term or long-term trends.

Incorporating technical analysis with Bank Nifty Weightage charts empowers traders to make data-driven decisions, optimize entry and exit points, and enhance risk management. It’s a versatile approach that offers insights into market sentiment and trend dynamics, helping traders gain a competitive edge in the Indian financial market.

Reading and Interpreting Bank Nifty Weightage Charts

Reading and interpreting Bank Nifty Weightage charts is a vital skill for traders and investors. Here’s how to effectively navigate these charts:

Understanding Axes: Familiarize yourself with the x-axis (time) and y-axis (weightage percentages) to grasp the chart’s structure.

Trend Identification: Identify trends by observing the direction of weightage movements, distinguishing between uptrends, downtrends, and consolidation.

Key Support and Resistance Levels: Locate crucial support and resistance levels on the chart, aiding in decision-making for entry and exit points.

Volume Analysis: Analyze accompanying volume bars to gauge the strength of price movements and confirm trend signals.

Use of Indicators: Employ technical indicators like RSI, moving averages, and trendlines to enhance your analysis and decision-making.

Advanced Chart Analysis Techniques for Bank Nifty Weightage

Advanced chart analysis techniques for Bank Nifty Weightage can help traders refine their strategies and gain a competitive edge:

Fibonacci Retracement: Utilize Fibonacci levels to identify potential support and resistance zones on weightage charts.

Elliot Wave Theory: Apply Elliot Wave principles to identify market cycles and predict potential trend reversals.

Ichimoku Cloud: Incorporate the Ichimoku Cloud indicator for a holistic view of trend direction, support, and resistance.

Bollinger Bands: Bollinger Bands offer insights into volatility and potential breakout points on weightage charts.

Candlestick Patterns: Recognize candlestick patterns to gauge market sentiment and anticipate price movements.

Maximize Your Profits with Expert Calls!

Access expert stock calls for quick profits. Trade with confidence through BankNifty.today’s insights!

FAQ

What is Bank Nifty Weightage?

Bank Nifty Weightage, also known as the weightage or weighting of individual banks in the Nifty Bank Index, is a measure that reflects the relative importance of each constituent bank in the index’s performance. The Nifty Bank Index is a stock market index that represents the performance of the banking sector in India. It includes the most liquid and prominent banking stocks listed on the National Stock Exchange (NSE) in India.

How is the weightage calculated in Bank Nifty?

Bank Nifty Weightage is calculated based on the free float market capitalization of the constituent banks. Free float market capitalization refers to the total market value of a company’s outstanding shares that are available for trading by the public. It excludes shares held by promoters, government entities, and other strategic investors.

Why is Bank Nifty Weightage important for investors?

Importance for Investors:

Bank Nifty Weightage is crucial for investors as it influences the performance of the Bank Nifty Index, which is widely followed by traders, investors, and fund managers.

– It helps investors understand the impact of individual bank stocks on the overall performance of the banking sector.

– Changes in Bank Nifty Weightage can affect the index’s movements and, consequently, the performance of mutual funds and exchange-traded funds (ETFs) that track the Bank Nifty Index.

How often is Bank Nifty Weightage updated?

Bank Nifty Weightage is typically updated periodically, usually on a quarterly basis. However, the exact frequency and timing of updates can vary based on the index provider’s methodology.

How does a change in Bank Nifty Weightage impact the index?

A change in the weightage of a bank can have a significant impact on the Bank Nifty Index. If a bank’s weightage increases, its price movements will have a more substantial effect on the index’s performance, and vice versa.

What are the criteria for a bank to be included in Bank Nifty?

The criteria for a bank to be included in the Bank Nifty Index typically include factors like market capitalization, liquidity, and trading volume. Banks meeting these criteria are selected for inclusion.

Can you explain the concept of free float market capitalization in Bank Nifty Weightage?

Free float market capitalization is the portion of a company’s market capitalization that represents shares available for trading in the open market. It excludes shares held by insiders, promoters, and other strategic investors. It’s used to determine the weightage of individual banks in Bank Nifty.

Summary: How Bank Nifty Weightage Affects Market Performance

Bank Nifty Weightage plays a pivotal role in shaping the overall performance of the Bank Nifty index and, by extension, the broader financial market. Understanding its impact is crucial for investors and traders. Here’s a summary of how Bank Nifty Weightage affects market performance:

1. Influence on Index Movements:

High-weight stocks in Bank Nifty can significantly sway the index’s direction. Their performance heavily influences the overall index movement.

2. Sectoral Dominance:

Bank Nifty Weightage reflects the dominance of the banking and financial sector within the Indian market. It’s a barometer of the sector’s health.

3. Diversification and Risk Management:

Investors use Bank Nifty Weightage data to diversify their portfolios, reducing concentration risk associated with highly-weighted stocks.

4. Volatility and Trading Opportunities:

Weightage changes can introduce volatility and create trading opportunities, as traders capitalize on price fluctuations.

5. Economic Barometer:

Bank Nifty Weightage reflects economic conditions, making it a valuable indicator for assessing the Indian economy’s health.

6. Market Sentiment:

Weightage changes often mirror market sentiment, offering insights into investor confidence and behavior.

In conclusion, Bank Nifty Weightage is more than just numbers on a chart. It’s a powerful tool that shapes market performance, influences investment decisions, and provides a window into the dynamics of the Indian financial sector. Those who grasp its nuances can navigate the market more effectively and make well-informed decisions.

SHARE:

Do you want

more profit?

Want to make money like the pros? 📈 We show you the easy way with tips everyone can use. Ready to start? 👍

Curious About Us?

At BankNifty.today, trading intelligence becomes your superpower. We demystify the stock market, making top-notch trading strategies accessible for everyone. Our platform is where beginners turn into savvy investors. Ready to take control of your financial destiny with us?

Get our Trading Tips for Free! 🎉

Sign up for our no-cost trial and see your trading improve.

Join our Telegram now!