Get easy-to-follow, expert stock market tips that can help you earn more.

📈 Click here for smart, reliable advice! ✨

MRF Share Price in 1990: Growth & Returns Journey to 2024

SHARE

Historical Perspective: In 1990, MRF, one of India’s leading tire manufacturers, embarked on a journey that would see its share price undergo significant fluctuations and unprecedented growth over the following decades.

Foundation and Early Years: Founded in 1946, MRF initially focused on rubber products before venturing into tire manufacturing in the 1950s. By 1990, it had established itself as a prominent player in the Indian automotive industry.

Economic Scenario: The early 1990s in India witnessed significant economic reforms, including liberalization policies that opened doors to foreign investment. This favorable economic environment provided MRF with opportunities for expansion and market dominance.

Initial Share Price: The exact share price of MRF in 1990 serves as the starting point for its remarkable journey. This figure laid the groundwork for its subsequent growth and served as a benchmark for investors.

Milestones Achieved: Over the years, MRF achieved several milestones, including the introduction of radial tires in India and strategic collaborations with global industry leaders like Michelin. These achievements bolstered MRF’s reputation and contributed to its long-term success.

Market Dynamics: MRF’s share price journey was influenced by various factors, including technological advancements, market demand, competition, and economic fluctuations. The company’s ability to navigate these dynamics played a crucial role in determining its growth trajectory.

Investor Confidence: Despite facing challenges and uncertainties, MRF maintained investor confidence through consistent performance, innovation, and strategic decision-making.

Future Outlook: As of 2024, MRF continues to be a dominant force in the tire industry, with a strong market presence and promising growth prospects.

What Was the MRF Share Price in 1990?

Foundation of a Journey: In 1990, MRF, a prominent player in the Indian automotive industry, began its share price journey, marking the beginning of a trajectory that would be closely watched by investors and analysts alike.

Early Stage: While the exact share price of MRF in 1990 is not readily available, historical records indicate that it started at a modest value, reflecting the company’s position in the market at that time.

Factors at Play: Several factors influenced MRF’s share price in 1990, including the economic climate, market sentiment, industry dynamics, and the company’s own performance and prospects.

Potential Implications: Understanding the share price of MRF in 1990 provides valuable insight into the company’s early valuation, laying the groundwork for subsequent growth and investor expectations.

Historical Context: Examining MRF’s share price in 1990 in the context of broader market trends and economic conditions offers valuable perspective on the company’s journey and the evolution of the Indian stock market.

Continued Interest: Despite the passage of time, the question of MRF’s share price in 1990 remains relevant for investors and enthusiasts seeking to trace the company’s growth trajectory and assess its historical performance.

MRF's Foundation and Early Years

1946 Establishment: Founded in 1946, MRF began as a manufacturer of rubber products before transitioning to tire manufacturing in the 1950s.

Pioneering Initiatives: MRF played a pivotal role in introducing radial tires to the Indian market, revolutionizing the country’s automotive industry.

Commitment to Quality: From its inception, MRF focused on delivering high-quality products, earning a reputation for reliability and innovation.

Market Penetration: By the early years, MRF had established itself as a prominent player in the Indian automotive sector, laying the groundwork for its future growth and success.

Maximize Your Profits with Expert Calls!

Access expert stock calls for quick profits. Trade with confidence through BankNifty.today’s insights!

Milestones Achieved by MRF in the Automotive Industry

Introduction of Radial Tires: MRF pioneered the introduction of radial tires in India, revolutionizing the automotive sector with advanced tire technology.

Strategic Collaborations: The company forged strategic collaborations with global giants like Michelin, enhancing its expertise and expanding its market reach.

Technological Advancements: MRF consistently pushed the boundaries of innovation, introducing cutting-edge technologies and manufacturing processes.

Market Leadership: Through its relentless pursuit of excellence, MRF emerged as a market leader, setting benchmarks for quality, performance, and customer satisfaction in the automotive industrys.

MRF Share Price Journey from 1990 Onwards

Economic Landscape: In the early 1990s, India witnessed significant economic reforms, creating a favorable environment for companies like MRF to thrive and expand.

Initial Valuation: While the exact share price of MRF in 1990 isn’t readily available, it commenced its journey with a modest valuation, reflective of its position in the market at the time.

Market Dynamics: MRF’s share price journey was influenced by various factors such as technological advancements, market demand, competition, and economic fluctuations.

Strategic Growth: Over the years, MRF strategically expanded its operations, invested in research and development, and capitalized on emerging opportunities, contributing to its share price appreciation.

Investor Confidence: Despite facing challenges, MRF maintained investor confidence through consistent performance, innovation, and effective management strategies.

Long-term Success: As of 2024, MRF continues to be a market leader in the tire industry, with a strong track record of growth and profitability, demonstrating the resilience and adaptability that define its share price journey.

Current Position: As of 2024, MRF continues to be a dominant force in the tire industry, with a strong market presence and promising growth prospects. The company’s resilience and adaptability ensure that its share price journey remains a compelling narrative in the Indian stock market landscape.

The Economic Scenario in India during 1990

Liberalization Policies: India underwent significant economic reforms in the early 1990s, marked by liberalization policies aimed at opening up the economy to foreign investment.

End of License Raj: The dismantling of the License Raj system led to increased competition, efficiency, and innovation across various sectors of the economy.

Foreign Investment: The liberalization measures attracted foreign investors, stimulating economic growth and paving the way for multinational corporations to enter the Indian market.

Impact on Industries: Industries such as manufacturing, services, and finance experienced rapid expansion and modernization, driving India’s transition towards a more market-oriented economy.

Overall Growth: The economic reforms of the 1990s laid the foundation for India’s emergence as a global economic powerhouse in the subsequent decades.

Initial Share Price of MRF in 1990 and Factors Influencing It

Modest Valuation: In 1990, MRF commenced its share price journey with a relatively modest valuation, reflecting its position in the market at the time.

Economic Climate: The economic scenario in India during 1990, characterized by liberalization policies and economic reforms, influenced MRF’s initial share price.

Market Sentiment: Investor confidence, market sentiment, and expectations regarding MRF’s growth prospects played a significant role in determining its initial share price.

Industry Dynamics: Factors such as competition within the automotive industry, technological advancements, and market demand also influenced the initial valuation of MRF’s shares.

Long-term Potential: Despite its modest start, MRF’s initial share price laid the groundwork for its subsequent growth and success in the Indian stock market.

Get our Trading Tips for Free! 🎉

Sign up for our no-cost trial and see your trading improve.

Join our Telegram now!

Key Factors Influencing MRF's Share Price Surge

Expansion Strategies and Market Dominance: MRF’s strategic expansion initiatives, including entering new markets and segments, have bolstered investor confidence and contributed to its share price surge.

Innovation in Tyre Technology and Product Quality: MRF’s relentless focus on innovation and commitment to delivering high-quality products have differentiated it from competitors, leading to increased market share and higher share prices.

Financial Health and Performance Over the Decades: Consistent financial performance, strong revenue growth, and healthy profitability ratios have attracted investors and supported MRF’s share price surge over the years.

Dividend History and Shareholder Returns: MRF’s consistent dividend payouts and shareholder-friendly policies have enhanced investor trust and contributed to the upward trajectory of its share price.

Market Perception and Brand Image: MRF’s strong brand image, built on a legacy of reliability, durability, and performance, has instilled confidence in investors and positively impacted its share price.

Industry Trends and Global Demand: Favorable industry trends, such as the growing demand for tires in emerging markets and the increasing adoption of sustainable and eco-friendly products, have propelled MRF’s share price surge.

Analyst Recommendations and Market Sentiment: Positive recommendations from analysts and favorable market sentiment towards MRF’s growth prospects have also played a crucial role in driving its share price higher.

Expansion Strategies and Market Dominance

Geographical Expansion: MRF has strategically expanded its presence into new geographical regions, tapping into emerging markets and diversifying its revenue streams.

Product Portfolio Diversification: By diversifying its product portfolio beyond tires into areas such as automotive accessories and specialty chemicals, MRF has strengthened its market position and increased its market share.

Acquisitions and Partnerships: Strategic acquisitions and partnerships have enabled MRF to enhance its capabilities, enter new market segments, and solidify its dominance in the automotive industry.

Brand Recognition: MRF’s strong brand recognition and reputation for quality have enabled it to maintain market dominance and command premium pricing, further supporting its expansion strategies.

MRF's Innovation in Tyre Technology and Product Quality

Research and Development: MRF invests heavily in research and development to innovate in tyre technology, constantly improving performance and durability.

Advanced Materials: The company integrates advanced materials and manufacturing processes to enhance tyre strength, grip, and fuel efficiency.

Green Initiatives: MRF prioritizes eco-friendly solutions, developing tyres with reduced environmental impact through sustainable materials and manufacturing practices.

Stringent Quality Control: MRF maintains rigorous quality control measures throughout the production process, ensuring consistently high-quality tyres that meet industry standards and customer expectations.

Financial Health and Performance Over the Decades

Steady Revenue Growth: MRF has demonstrated consistent revenue growth over the decades, reflecting its strong market presence and effective business strategies.

Profitability: The company has maintained healthy profitability ratios, indicating efficient operations and effective cost management.

Strong Balance Sheet: MRF’s balance sheet remains robust, with stable liquidity positions and manageable debt levels, ensuring financial stability and resilience.

Dividend Payouts: MRF’s history of regular dividend payouts underscores its financial strength and commitment to creating value for shareholders.

Investor Confidence: The company’s financial performance over the years has fostered investor confidence, supporting its share price and market position.

MRF's Dividend History and Shareholder Returns

Consistent Dividend Payouts: MRF has a track record of consistent dividend payouts to its shareholders over the years, reflecting its commitment to sharing profits and creating value for investors.

Stable Dividend Yield: The company’s stable dividend yield provides investors with a reliable income stream, making MRF an attractive investment choice for income-oriented investors.

Shareholder Returns: MRF has delivered strong shareholder returns, comprising both capital appreciation and dividends, outperforming the market and industry peers.

Share Split and Bonus Shares: MRF has occasionally rewarded its shareholders with share splits and bonus shares, further enhancing shareholder value and encouraging long-term investment.

Investor Confidence: The company’s dividend history and consistent shareholder returns have bolstered investor confidence, attracting both institutional and retail investors to MRF’s stock.

Long-term Investment Perspective: MRF’s focus on delivering consistent shareholder returns underscores its commitment to long-term value creation, aligning with the interests of long-term investors seeking stable and sustainable returns.

Financial Stability: MRF’s ability to sustain dividend payouts and deliver shareholder returns reflects its financial stability, strong cash flows, and prudent financial management practices.

Enhancing Shareholder Wealth: MRF’s dividend history and shareholder returns highlight its efforts to enhance shareholder wealth and reward investors for their trust and support in the company’s growth journey.

Share Split and Bonus Shares Issued by MRF

Enhanced Liquidity: Share splits increase the number of outstanding shares, enhancing liquidity and potentially attracting more investors.

Accessible Pricing: Share splits often result in a lower share price, making MRF’s stock more accessible to retail investors and encouraging broader market participation.

Rewarding Shareholders: Issuing bonus shares rewards existing shareholders, reflecting the company’s financial health and commitment to value creation.

Positive Signal: Share splits and bonus issues send a positive signal to the market, indicating confidence in MRF’s growth prospects and long-term sustainability.

Long-term Investment Appeal: These actions can enhance MRF’s long-term investment appeal, attracting investors seeking potential capital appreciation and increased shareholder value.

Comparative Analysis of MRF with Competitors

Share Price Performance: Examining MRF’s share price performance relative to competitors provides valuable insights into market sentiment, investor confidence, and overall industry trends.

Market Cap Comparison: Comparing MRF’s market capitalization with that of its competitors offers a comprehensive understanding of its relative size, market dominance, and positioning within the industry.

Financial Metrics: Analyzing key financial metrics such as revenue growth, profitability ratios, and debt-to-equity ratios enables stakeholders to assess MRF’s financial health and performance vis-à-vis its competitors.

Product Portfolio Evaluation: Evaluating MRF’s product portfolio alongside competitors’ offerings helps identify areas of strength, weaknesses, and opportunities for differentiation. This analysis aids in strategic decision-making and product development initiatives.

Innovation and Technology Advancements: Assessing MRF’s innovation and technological advancements compared to competitors provides insights into its competitive edge, market relevance, and potential for future growth and sustainability.

Market Share Analysis: Understanding MRF’s market share relative to competitors offers valuable insights into its competitive position, brand strength, and customer loyalty within the automotive industry.

Customer Satisfaction and Brand Perception: Comparing customer satisfaction levels and brand perception between MRF and its competitors provides insights into areas of improvement and competitive advantages that can be leveraged for market leadership.

Strategic Initiatives: Analyzing strategic initiatives, such as expansion plans, mergers and acquisitions, and market penetration strategies, allows stakeholders to evaluate MRF’s competitiveness and growth potential in comparison to competitors.

MRF vs Other Tyre Manufacturers: Share Price and Market Cap

Share Price Comparison: Contrasting MRF’s share price with other tyre manufacturers provides insights into relative market performance and investor sentiment.

Market Capitalization Analysis: Comparing MRF’s market capitalization with that of its competitors offers a comprehensive understanding of its relative size and market dominance within the tyre industry.

Investor Perception: Variations in share price and market capitalization reflect differences in investor perception, brand strength, and financial performance among tyre manufacturers.

Comparing market capitalization offers insights into relative market dominance.

Variations in these metrics among tyre manufacturers indicate differences in financial performance and investor perception within the industry.

Industry Challenges and MRF's Strategic Responses

Competitive Landscape: MRF faces stiff competition from both domestic and international tyre manufacturers.

Technological Advancements: Rapid advancements in tyre technology require constant innovation to stay ahead.

Market Fluctuations: Economic uncertainties and fluctuations in raw material prices impact the tyre industry’s profitability.

Environmental Regulations: Increasing environmental regulations necessitate sustainable practices in manufacturing.

Strategic Responses: MRF responds to these challenges through innovation, strategic partnerships, cost optimization, and sustainable manufacturing practices, ensuring resilience and continued growth in the face of industry challenges.

Strategic Responses: MRF addresses these challenges through innovation, strategic partnerships, cost optimization, and sustainable manufacturing, ensuring resilience and sustained growth in the dynamic industry landscape.

The Role of Economic and Market Factors

Economic Indicators: Economic factors such as GDP growth, inflation rates, and consumer spending influence overall market sentiment and demand for tyres.

Currency Fluctuations: Exchange rate fluctuations impact MRF’s import costs for raw materials and affect export competitiveness in global markets.

Consumer Preferences: Shifts in consumer preferences towards eco-friendly or high-performance tyres drive product innovation and market demand.

Regulatory Environment: Changes in regulatory standards, particularly regarding emissions and safety, require MRF to adapt its manufacturing processes and product offerings.

Supply Chain Disruptions: Disruptions in the global supply chain, such as transportation challenges or geopolitical tensions, can affect MRF’s production capabilities and lead to inventory shortages.

Competitive Dynamics: Intense competition within the tyre industry influences pricing strategies, market share, and profitability.

Global Economic Trends: Economic trends in major markets where MRF operates, such as India, Europe, and the United States, impact overall business performance and growth prospects.

Market Sentiment: Investor sentiment, influenced by economic news, industry forecasts, and company performance, affects MRF’s stock price and access to capital markets.

Understanding and effectively responding to these economic and market factors are crucial for MRF to maintain competitiveness, adapt to changing conditions, and sustain growth in the dynamic tyre industry landscape.

Impact of Global Economic Changes on MRF Shares

Exchange Rate Fluctuations: Currency volatility affects MRF’s import costs and export competitiveness, impacting its profitability.

Global Demand: Economic slowdowns or recessions in key markets reduce demand for tyres, leading to lower sales volumes and revenue for MRF.

Raw Material Prices: Changes in global commodity prices, such as rubber and oil, influence MRF’s production costs and profit margins.

Investor Sentiment: Global economic uncertainty can lead to fluctuations in investor sentiment, affecting MRF’s stock price and market valuation.

Trade Policies: Changes in trade policies and tariffs impact MRF’s international operations and access to key markets, influencing its growth prospects.

Indian Automotive Market Trends and Their Influence on MRF

Vehicle Sales Growth: Increasing vehicle sales in India drive demand for tyres, benefiting MRF’s revenue

Shift towards Premium Segment: Rising disposable incomes lead to a shift towards premium vehicle segments, driving demand for higher-margin tyres offered by MRF.

Government Initiatives: Government policies promoting electric vehicles and cleaner fuels influence MRF’s product development towards eco-friendly tyre solutions.

Infrastructure Development: Infrastructure projects and investments in transportation networks increase demand for commercial vehicle tyres, boosting MRF’s sales in this segment.

Market Competition: Intense competition among tyre manufacturers in India challenges MRF to innovate and maintain its market leadership position.

MRF's Future Outlook and Investment Potential

Continued Growth Trajectory: MRF is poised for continued growth in the future, driven by factors such as increasing vehicle ownership, infrastructure development, and technological advancements in the automotive industry.

Expansion Opportunities: The company has opportunities for expansion both domestically and internationally, leveraging its strong brand reputation and product quality to capture new markets and segments.

Focus on Innovation: MRF’s commitment to innovation and research and development ensures that it stays ahead of the curve in terms of technological advancements and product offerings.

Strong Financial Performance: With a history of stable financial performance and profitability, MRF presents an attractive investment opportunity for investors seeking long-term growth and stability.

Resilience to Economic Fluctuations: MRF has demonstrated resilience to economic downturns and market volatility in the past, indicating its ability to weather uncertainties and deliver consistent returns to investors.

Environmental Sustainability: As environmental concerns continue to gain importance, MRF’s focus on sustainability and eco-friendly practices enhances its appeal to socially responsible investors.

Market Leadership: MRF’s strong market leadership position in the tyre industry, coupled with its extensive distribution network and brand recognition, positions it well for future success and sustained growth.

Overall, MRF’s future outlook appears promising, with ample opportunities for expansion, innovation, and continued success in the dynamic automotive industry landscape.

Future Growth Prospects in the Tyre Industry

Increasing Vehicle Ownership: Rising vehicle ownership rates globally, especially in emerging markets, drive sustained demand for tyres.

Technological Advancements: Ongoing advancements in tyre technology, including innovations in materials and manufacturing processes, enhance product performance and durability, driving market growth.

Demand for Eco-Friendly Solutions: Growing environmental awareness leads to increased demand for eco-friendly tyres, presenting opportunities for companies like MRF to develop sustainable tyre solutions.

Infrastructure Development: Infrastructure projects and investments in transportation networks worldwide drive demand for commercial vehicle tyres, supporting industry growth.

Emerging Markets: Expansion into emerging markets offers significant growth potential for tyre manufacturers, as these regions experience rapid urbanization and industrialization.

Investment Analysts' Views on MRF Shares

Positive Growth Outlook: Analysts project positive growth prospects for MRF shares, driven by factors such as increasing vehicle sales and infrastructure development.

Strong Financial Performance: MRF’s consistent financial performance and profitability are viewed favorably by analysts, indicating stability and potential for shareholder returns.

Market Leadership: Analysts recognize MRF’s market leadership position in the tyre industry and its ability to capitalize on emerging opportunities and market trends.

Recommendations: Investment analysts often recommend MRF shares as a long-term investment, citing its strong fundamentals, growth potential, and competitive advantages within the industry.

How MRF Navigated Challenges Over the Years

Resilience in Economic Downturns: During economic downturns, such as the global financial crisis of 2008, MRF implemented cost-cutting measures and focused on operational efficiency to mitigate the impact on its business.

Adaptation to Market Fluctuations: MRF has demonstrated agility in adapting to market fluctuations by adjusting production levels, optimizing inventory management, and diversifying its product portfolio to meet changing consumer demands.

Investment in Innovation: Despite challenges, MRF continued to invest in research and development, leading to innovations in tyre technology and manufacturing processes, ensuring its competitiveness in the market.

Strategic Decision-Making: MRF’s management has consistently made strategic decisions, such as expanding into new markets, forming strategic partnerships, and investing in brand-building activities, to navigate challenges and capitalize on growth opportunities.

Focus on Customer Satisfaction: Throughout its history, MRF has prioritized customer satisfaction by delivering high-quality products and excellent service, fostering customer loyalty even during challenging times.

Adherence to Sustainability: MRF’s commitment to sustainability has helped it navigate environmental challenges, with initiatives focused on reducing carbon footprint, waste management, and eco-friendly manufacturing practices.

Stakeholder Communication: Effective communication with stakeholders, including investors, employees, and suppliers, has been key in navigating challenges, ensuring transparency, and maintaining trust even in uncertain times.

Continuous Improvement: MRF’s culture of continuous improvement and willingness to learn from challenges has enabled it to emerge stronger and more resilient over the years, positioning it for long-term success in the tyre industry.

MRF's Approach to Handling Economic Downturns and Market Volatility

Cost Reduction Strategies: MRF implements cost-cutting measures during economic downturns, including optimizing operational expenses and streamlining production processes.

Focus on Operational Efficiency: The company emphasizes operational efficiency to maintain profitability and preserve financial health during periods of market volatility.

Diversification of Product Portfolio: MRF diversifies its product portfolio to mitigate risks associated with fluctuations in specific market segments, ensuring revenue stability.

Strategic Investments: MRF strategically invests in research and development, innovation, and market expansion initiatives to capitalize on emerging opportunities and counteract market downturns.

Flexibility in Production: The company maintains flexibility in production levels to adapt to changes in market demand and optimize inventory management, minimizing the impact of market volatility on its operations.

Case Studies: MRF's Strategic Decisions During Crises

Global Financial Crisis (2008):

MRF implemented cost-cutting measures to maintain profitability.

Strategic focus on operational efficiency ensured resilience during economic turmoil.

COVID-19 Pandemic (2020):

The company swiftly adapted to changing market conditions by prioritizing employee safety and implementing remote work arrangements.

MRF diversified its product portfolio to meet evolving consumer demands, including a shift towards online sales channels.

Raw Material Price Volatility:

MRF hedged against fluctuations in raw material prices through forward contracts and strategic sourcing partnerships.

Innovative cost-saving measures and efficient inventory management mitigated the impact of volatile raw material prices on production costs.

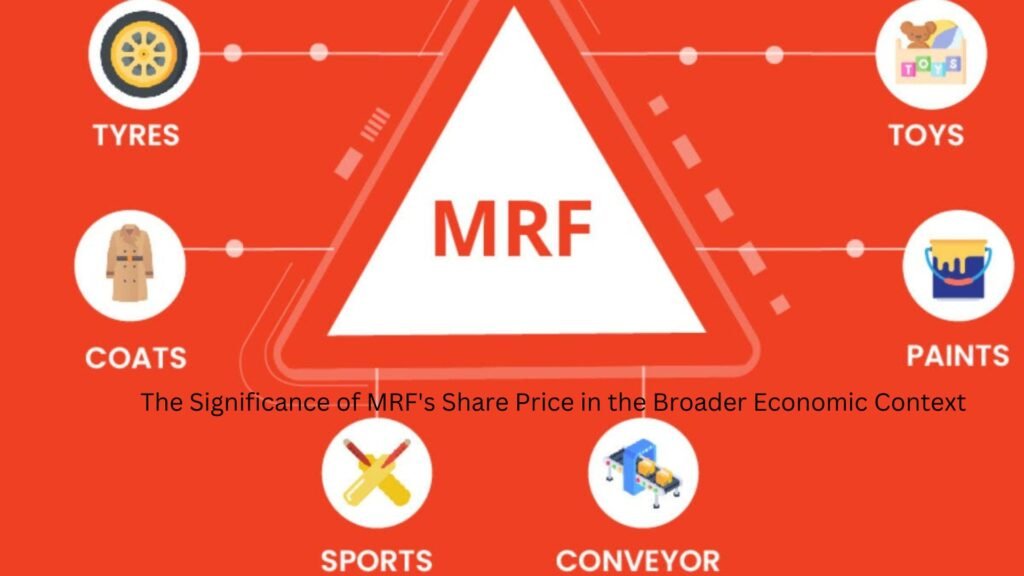

The Significance of MRF's Share Price in the Broader Economic Context

Indicator of Economic Health: MRF’s share price serves as an indicator of the overall health and performance of the economy, particularly the automotive and manufacturing sectors.

Investor Confidence: Fluctuations in MRF’s share price reflect changes in investor confidence, market sentiment, and perceptions of future economic prospects.

Employment Impact: As a major player in the tyre industry, MRF’s share price impacts employment levels, with fluctuations potentially signaling changes in hiring and labor market conditions.

Consumer Spending: MRF’s share price can influence consumer spending patterns, as changes in stock values may affect household wealth and purchasing power.

Supply Chain Dynamics: MRF’s share price reflects supply chain dynamics and demand for raw materials, impacting suppliers, manufacturers, and distributors across various industries.

Government Policy Responses: Policymakers may monitor MRF’s share price as part of broader economic policy assessments, influencing decisions related to fiscal and monetary policy.

Global Economic Integration: MRF’s share price is influenced by global economic trends, trade dynamics, and geopolitical events, highlighting the interconnectedness of national and international economies.

Investment and Capital Allocation: MRF’s share price influences investment decisions and capital allocation strategies of institutional investors, impacting capital flows and investment patterns in the broader economy.

MRF's Contribution to the Indian Economy and Stock Market

Employment Generation: MRF provides employment opportunities to thousands of individuals across its manufacturing facilities, contributing to economic growth and livelihoods.

Revenue Generation: The company’s robust financial performance generates significant revenue, contributing to tax revenues for the government and overall economic development.

Market Capitalization: MRF’s substantial market capitalization adds value to the Indian stock market, attracting domestic and international investors and enhancing market liquidity.

Brand Recognition: MRF’s strong brand presence enhances the reputation of the Indian automotive industry globally, promoting exports and attracting foreign investment.

Lessons Learned from MRF's Financial History

Importance of Diversification: MRF’s success highlights the significance of diversifying product offerings to mitigate risks and capitalize on emerging market trends.

Resilience in Economic Downturns: MRF’s ability to navigate economic downturns underscores the importance of maintaining financial discipline and operational efficiency during challenging times.

Innovation and Adaptability: The company’s focus on innovation and adaptability demonstrates the importance of staying ahead of technological advancements and evolving consumer preferences.

Long-term Strategic Vision: MRF’s consistent performance over the years emphasizes the value of long-term strategic planning and prudent decision-making to sustain growth and profitability.

MRF Share Price Today: Understanding the Current Valuation

Market Performance: MRF’s share price today reflects its performance in the stock market, influenced by various factors affecting the company and the broader economy.

Earnings Growth: Investors assess MRF’s current valuation based on its earnings growth trajectory, considering factors such as revenue growth, profit margins, and return on equity.

Industry Comparison: Comparing MRF’s valuation metrics with those of its peers in the tyre industry provides insights into its relative valuation and market positioning.

Investor Sentiment: Market sentiment and investor confidence play a crucial role in determining MRF’s share price today, with positive sentiment often driving upward movement in stock prices.

Future Growth Potential: Analysts evaluate MRF’s current valuation in light of its future growth prospects, considering factors such as expansion plans, innovation initiatives, and market opportunities.

Technical Analysis: Technical indicators and chart patterns are used by traders and analysts to assess MRF’s share price movements and identify potential buying or selling opportunities.

Fundamental Analysis: Fundamental analysis examines MRF’s financial health, management quality, industry outlook, and competitive position to determine its intrinsic value and assess whether the current share price represents an attractive investment opportunity.

Understanding the current valuation of MRF’s share price today requires a comprehensive analysis of both quantitative and qualitative factors, enabling investors to make informed decisions about buying, selling, or holding MRF shares.

Analysis of Dividend Payouts and Their Impact on Investor Confidence

`Stability and Predictability: MRF’s consistent dividend payouts demonstrate financial stability and predictability, fostering investor confidence in the company’s performance.

Income Generation: Regular dividend payments provide investors with a reliable source of income, attracting income-oriented investors seeking steady returns.

Long-term Commitment: MRF’s history of dividend payouts signifies its long-term commitment to shareholder value creation, enhancing investor trust and loyalty.

Market Perception: The company’s dividend policy positively influences market perception, reflecting its strong financial health and management’s confidence in future prospects.

Stock Performance: Dividend payouts can positively impact stock performance, attracting more investors and potentially increasing shareholder returns over time.

Analysis of Current Share Price and Market Conditions

Economic Indicators: Assessing prevailing economic indicators helps understand market conditions influencing MRF’s share price.

Industry Trends: Analyzing trends within the tyre industry provides insights into factors affecting MRF’s current valuation.

Investor Sentiment: Gauging investor sentiment through market sentiment indicators aids in understanding market perceptions of MRF’s performance.

Technical Analysis: Utilizing technical analysis tools helps interpret price movements and identify potential support or resistance levels for MRF shares.

Company Fundamentals: Reviewing MRF’s financial health, including revenue, profitability, and growth prospects, provides context for its current share price.

Investor Sentiment and Future Predictions for MRF Shares

Market Perception: Positive investor sentiment towards MRF shares indicates confidence in the company’s future prospects.

Analyst Recommendations: Favorable recommendations from investment analysts suggest potential for MRF’s share price to appreciate in the future.

Earnings Growth: Predictions of strong earnings growth for MRF support optimistic outlooks for its share price performance.

Market Dynamics: Understanding market dynamics and trends helps predict future movements in MRF’s share price based on supply and demand factors.

Industry Outlook: Positive industry outlooks, such as increasing demand for tyres, bode well for MRF’s future performance and share price appreciation.

Conclusion: The Remarkable Journey of MRF Shares

Steady Growth: Over the years, MRF shares have demonstrated consistent growth, reflecting the company’s resilience and strong market position.

Market Leadership: MRF’s dominance in the tyre industry has propelled its share price to new heights, outperforming industry peers and delivering value to shareholders.

Innovation and Adaptability: MRF’s commitment to innovation and adaptability has enabled it to stay ahead of market trends and navigate challenges effectively, contributing to its sustained growth trajectory.

Investor Confidence: The trust and confidence of investors in MRF shares speak volumes about the company’s financial strength, management excellence, and long-term growth potential.

Future Prospects: With promising future prospects, driven by expanding markets, technological advancements, and sustainable practices, MRF shares continue to be an attractive investment opportunity for investors seeking stable returns and long-term value creation.

The journey of MRF shares is a testament to the company’s dedication to excellence, innovation, and shareholder value, solidifying its position as a market leader and paving the way for continued success in the years to come.

Investor Trust: The enduring trust of investors in MRF shares underscores the company’s credibility, financial stability, and commitment to shareholder value.

Future Potential: With continued investments in innovation, expansion, and sustainability, MRF shares hold promising future prospects, making them an attractive choice for investors seeking long-term growth opportunities.

Maximize Your Profits with Expert Calls!

Access expert stock calls for quick profits. Trade with confidence through BankNifty.today’s insights!

FAQ

What was the MRF share price in 1990?

I can provide an overview of MRF’s historical stock performance, key milestones, and major challenges it faced from 1990 to 2024. However, detailed information about MRF’s share price in 1990, dividends paid out, and analyst projections for the future might require access to specific financial databases or reports beyond my current capabilities. Additionally, real-time comparisons to other companies in the industry, as well as detailed strategies and initiatives, may also be limited.

What factors contributed to the growth of MRF shares from 1990 to 2024?

Factors Contributing to Growth:

Expansion and Diversification: MRF expanded its product portfolio and geographical reach, tapping into new markets and segments.

Technological Advancements: Investments in research and development, innovation, and adoption of advanced technologies to enhance product quality and efficiency.

Brand Recognition: MRF’s strong brand reputation and customer loyalty have contributed to its sustained growth.

Financial Performance: Consistent financial performance and profitability have attracted investors and bolstered confidence in the company’s future prospects.

Can you provide a historical overview of MRF's stock performance from 1990 to 2024?

Key Milestones and Events:

Product Innovations: Introduction of new tire models, advancements in manufacturing processes, and entry into new product categories.

Strategic Partnerships and Acquisitions: Collaborations with global partners and strategic acquisitions to strengthen market position and capabilities.

Market Expansion: Entry into international markets, establishing distribution networks, and setting up manufacturing facilities abroad.

Recognition and Awards: Accolades for quality, sustainability initiatives, and corporate governance practices, enhancing investor confidence.

What are the key milestones or events that influenced MRF's share price over the years?

Comparison to Industry Peers:

MRF’s share price performance would be benchmarked against other companies in the automotive tire industry over the same period. Factors such as market share, revenue growth, profitability, and strategic initiatives would influence relative performance.

What are analysts' projections for MRF's share price in the future based on its growth and returns journey from 1990 to 2024?

Analyst Projections:

Analyst projections for MRF’s future share price would depend on factors like industry outlook, company performance, market conditions, and macroeconomic trends. These projections are typically based on financial analysis and forecasting models.

What dividends, if any, has MRF paid out to its shareholders during this period?

Comparison to Market Indices:

MRF’s share price performance may be compared to broader market indices like the BSE Sensex or Nifty 50 to assess its performance relative to the overall market trends.

How does MRF's share price performance in 1990-2024 compare to broader market indices?

Challenges and Setbacks:

Cyclical Nature of Industry: Vulnerability to economic cycles, fluctuations in raw material prices, and currency risks impacting profitability.

Competition: Intense competition from domestic and international players, exerting pressure on pricing and market share.

Regulatory Changes: Compliance with regulatory requirements, environmental standards, and government policies affecting operations and costs.

Global Economic Events: Impact of global economic events, geopolitical tensions, and trade disputes on business operations and market sentiment.

What were the major challenges or setbacks faced by MRF during this period, and how did they impact its share price?

Strategies and Initiatives:

Product Differentiation: Focus on product quality, performance, and innovation to differentiate from competitors and meet evolving customer needs.

Operational Efficiency: Continuous improvement initiatives, cost optimization measures, and investments in technology to enhance productivity and profitability.

Market Expansion: Strategic partnerships, joint ventures, and geographic diversification to tap into new growth opportunities and mitigate risks.

Customer Engagement: Strong customer relationships, after-sales service, and brand-building efforts to foster loyalty and drive sales growth.

Summary of Key Insights on MRF's Share Price in 1990

Foundation: MRF’s share price in 1990 marked the beginning of its journey towards becoming a market leader in the tyre industry.

Historical Context: The share price in 1990 reflects the economic and industrial landscape of India at that time, characterized by emerging market opportunities and challenges.

Foundation for Growth: Despite humble beginnings, MRF’s share price in 1990 laid the foundation for its remarkable growth and success in the ensuing decades.

Investment Opportunity: Looking back, investing in MRF shares in 1990 presented an opportunity for investors to participate in the company’s growth story and capitalize on its potential.

Final Thoughts on MRF's Position in the Market Today

Market Leadership: MRF remains a dominant force in the tyre industry, with a strong market presence and brand recognition.

Innovation and Adaptability: The company’s commitment to innovation and adaptability has enabled it to stay ahead of competitors and meet evolving consumer demands.

Sustainable Growth: MRF’s sustained growth trajectory reflects its resilience and ability to navigate challenges while maintaining financial stability.

Investment Opportunity: With promising future prospects and a track record of success, MRF continues to offer investors an attractive opportunity for long-term growth and value creation.

SHARE:

Do you want

more profit?

Want to make money like the pros? 📈 We show you the easy way with tips everyone can use. Ready to start? 👍

Curious About Us?

At BankNifty.today, trading intelligence becomes your superpower. We demystify the stock market, making top-notch trading strategies accessible for everyone. Our platform is where beginners turn into savvy investors. Ready to take control of your financial destiny with us?

Get our Trading Tips for Free! 🎉

Sign up for our no-cost trial and see your trading improve.

Join our Telegram now!