Get easy-to-follow, expert stock market tips that can help you earn more.

📈 Click here for smart, reliable advice! ✨

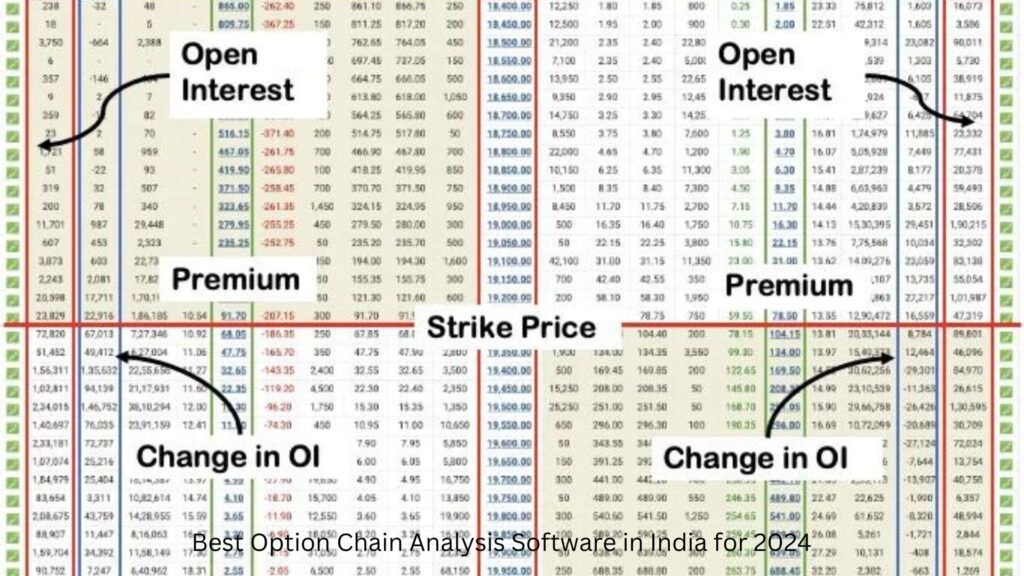

🌟 Best Option Chain Analysis Software in India for 2024

Are you seeking the ultimate edge in the Indian stock market for 2024? Look no further – the best Option Chain Analysis Software is here to transform your trading game. In this article, we will unveil the top software in India for 2024, equipping you with the tools to make smarter trading decisions.

Why Option Chain Analysis Software?

Option Chain Analysis Software provides a comprehensive view of the options market, allowing you to make data-driven choices.

It offers insights into strike prices, open interest, volume, and other critical data points, enabling informed decision-making.

The Top Software for 2024

Option Action: Known for its user-friendly interface and real-time data, Option Action is a go-to choice for traders. It offers live market analysis and predictive tools.

NSE India: NSE India provides a robust platform for option chain analysis. It’s trusted by professionals for its accuracy and depth of information.

Investar: Investar’s Option Chain Analysis Software is ideal for both beginners and experts. It offers a wide range of technical indicators for comprehensive analysis.

Why 2024 Matters

The year 2024 presents unique opportunities and challenges in the Indian stock market.

Volatility and market fluctuations demand smarter strategies, making Option Chain Analysis Software indispensable.

Conclusion

For traders seeking an advantage in the dynamic Indian stock market of 2024, Option Chain Analysis Software is the key. With the top software options at your disposal, you can stay ahead of market trends and make informed choices. Don’t miss out on the potential for greater success in the year ahead.

What is Option Chain Analysis Software and How Can It Benefit Traders?

Option Chain Analysis Software is a powerful tool that provides traders with valuable insights into the options market. It is a critical resource for traders of all levels, offering a deeper understanding of market dynamics and aiding in decision-making. Let’s explore what Option Chain Analysis Software is and how it can benefit traders:

Understanding Option Chain Analysis Software:

Option Chain Analysis Software is designed to analyze the option chain, which comprises call and put options for a specific stock or index.

It provides a comprehensive view of the available options, strike prices, open interest, volume, and more.

This software is an essential component of modern trading strategies, helping traders make data-driven decisions.

Benefits for Traders:

Market Insight: Option Chain Analysis Software offers valuable market insights, helping traders gauge market sentiment and identify potential support and resistance levels.

Risk Management: It aids in risk management by allowing traders to visualize potential profit and loss scenarios before executing trades.

Strategy Development: Traders can use the software to develop and backtest trading strategies, optimizing their approach for different market conditions.

Real-time Data: Many option chain analysis tools provide real-time data, allowing traders to stay updated with market changes.

For All Traders:

Option Chain Analysis Software is valuable for both beginners and experienced traders.

It empowers traders with the information needed to make informed decisions, whether they are day traders, swing traders, or long-term investors.

Understanding the Basics of Option Chain Analysis

Option Chain Analysis is a fundamental tool for traders seeking to navigate the complex world of options trading. Here’s a quick overview of its basics:

Option Chain: The option chain is a list of all available call and put options for a specific stock or index.

Strike Prices: Option chains display various strike prices, allowing traders to choose the right entry and exit points.

Open Interest: This figure represents the number of outstanding contracts, indicating market interest.

Volume: The daily trading volume of options can provide insights into market sentiment.

Expiration Dates: Option chains show multiple expiration dates, enabling traders to plan their positions.

Maximize Your Profits with Expert Calls!

Access expert stock calls for quick profits. Trade with confidence through BankNifty.today’s insights!

Key Features of Top Option Chain Analysis Software

When choosing Option Chain Analysis Software, understanding its key features is crucial. Here are the standout features offered by top options:

Real-Time Data: Access to live market data ensures you make informed decisions in a dynamic market.

Customizable Alerts: Set alerts for specific price levels or option chain changes to stay on top of your trades.

Advanced Charts: Rich charting tools allow for in-depth technical analysis of options and underlying assets.

Risk Analysis: Evaluate potential risks and rewards before entering a trade with advanced risk assessment tools.

Strategy Simulation: Test your trading strategies with simulated trading to refine your approach.

Historical Data: Access historical option chain data to analyze trends and patterns.

Options Greeks: Calculate options Greeks like delta, gamma, and theta for precise risk management.

Multi-Platform Access: Ensure compatibility with various devices and operating systems for flexibility.

Choosing the Best Option Chain Analysis Software for Your Needs

Option Chain Analysis Software is a valuable tool for traders seeking to make informed decisions in the complex world of options trading. With numerous options available, it’s essential to choose the software that aligns with your specific trading needs and objectives. Here are key considerations to help you make the right choice:

1. Data Accuracy and Reliability

Accurate and real-time data is paramount. Ensure the software provides trustworthy market information, as even slight discrepancies can impact trading outcomes.

2. User-Friendly Interface

A user-friendly interface streamlines your trading experience. Opt for software that offers an intuitive design, making it easier to navigate and utilize its features effectively.

3. Customization Options

Traders have varying preferences and strategies. Choose software that allows customization of charts, alerts, and other features to match your unique trading style and goals.

4. Technical Analysis Tools

In-depth market analysis requires robust technical analysis tools. Verify that the software offers advanced charting capabilities and a comprehensive array of technical indicators.

5. Risk Management Features

Effective risk management is a cornerstone of successful trading. Look for software that provides risk assessment tools, options Greeks calculations, and other risk management features.

6. Backtesting and Simulation

The ability to backtest and simulate trading strategies is invaluable for refining and optimizing your approach. Ensure the software offers these capabilities for ongoing improvement.

Free vs. Paid Option Chain Analysis Tools: What's Right for You?

When it comes to Option Chain Analysis Tools, traders often face the dilemma of choosing between free and paid options. Here’s a quick comparison to help you decide:

Free Tools:

Cost-effective: Ideal for beginners or traders on a tight budget.

Limited Features: Basic functionality with fewer advanced features.

Limited Data: May not provide real-time data or historical data depth.

Suitable for Learning: Good for those exploring options trading without a significant financial commitment.

Paid Tools:

Comprehensive Features: Offers advanced features, customization, and in-depth analysis tools.

Real-time Data: Access to real-time and historical data for accurate decision-making.

Enhanced Support: Typically comes with customer support for technical assistance.

Professional Traders: Preferred by experienced traders who require precision and advanced capabilities.

Top Rated Option Chain Analysis Software in India

When it comes to Option Chain Analysis Software in India, several options stand out for their features and reliability. Here are some of the top-rated choices:

Option Action: Known for its real-time data and user-friendly interface, Option Action is a favorite among traders.

NSE India: The National Stock Exchange’s own platform offers comprehensive and trusted option chain analysis tools.

Investar: This software is highly regarded for its versatility, catering to both beginners and experts with a wide range of technical indicators.

These top-rated options provide invaluable insights into the options market, helping traders make informed decisions and optimize their trading strategies in the Indian stock market.

Get our Trading Tips for Free! 🎉

Sign up for our no-cost trial and see your trading improve.

Join our Telegram now!

Innovative Features of Nifty Option Chain Analysis Software

Nifty Option Chain Analysis Software is a powerful tool for traders looking to navigate the dynamic world of the Indian stock market. Here are some innovative features that set it apart:

Real-time Market Data: Stay ahead with real-time data, enabling instant analysis of market movements and trends.

Options Greeks Calculations: Precisely calculate options Greeks like delta, gamma, and theta to fine-tune your strategies.

Customized Alerts: Set personalized alerts for specific price levels or market changes, ensuring you don’t miss out on trading opportunities.

Advanced Charting Tools: Utilize advanced charting features and technical indicators for in-depth analysis and informed decision-making.

Risk Management: Assess potential risks and rewards with comprehensive risk management tools, enhancing your overall trading strategy.

Historical Data Analysis: Access historical option chain data to identify patterns and trends, helping you make better-informed choices.

Strategy Simulation: Test your trading strategies in a risk-free environment through simulation, allowing you to refine your approach.

Multi-Platform Compatibility: Ensure flexibility by using the software across various devices and operating systems.

Option Chain Comparisons: Compare different option chains and make informed choices based on a comprehensive analysis of available options.

Nifty Option Chain Analysis Software empowers traders with these innovative features, offering a competitive advantage in the Indian stock market. Whether you are a beginner or an experienced trader, these tools can enhance your trading experience and boost your chances of success.

How Nifty Trader's Option Chain Software Enhances Market Insight

Nifty Trader’s Option Chain Software is a game-changer for traders seeking a deeper understanding of the Indian stock market. Here’s how it elevates market insight:

Real-Time Data: Access to real-time market data ensures you stay updated with the latest price movements and trends.

Options Greeks Analysis: Precise calculations of options Greeks like delta, gamma, and theta provide insights into risk and potential returns.

Historical Data: Dive into historical option chain data to identify patterns, making more informed trading decisions.

Custom Alerts: Set customized alerts for price levels or market changes, ensuring you never miss crucial opportunities.

Strategy Simulation: Test and refine trading strategies through simulation, optimizing your approach.

Live Option Chain Analysis: Staying Ahead of Market Trends

Live Option Chain Analysis is a vital tool for traders aiming to outpace market trends. Here’s how it keeps you in the driver’s seat:

Real-Time Updates: Stay ahead with live, minute-by-minute updates on option chain data, ensuring you’re never caught off guard.

Immediate Insights: Instant access to data empowers you to make quick, informed decisions as market conditions change.

Intraday Precision: Capitalize on intraday opportunities with real-time data, optimizing your trading strategies.

Dynamic Strategies: Adjust your trading strategies on the fly based on live market information, increasing your chances of success.

Live Option Chain Analysis is the key to agility in the fast-paced world of trading, helping you adapt to market shifts and capitalize on emerging trends.

Comprehensive Guide to Using Option Chain Analysis Tools Effectively

Option Chain Analysis Tools are essential for traders looking to navigate the complexities of the options market. Here’s a comprehensive guide to help you use these tools effectively:

Understanding the Basics:

Begin with a solid understanding of what option chains are and how they work.

Familiarize yourself with key terms like strike prices, open interest, and volume.

Choosing the Right Tool:

Select a reputable Option Chain Analysis Tool that suits your trading style and objectives.

Ensure it provides real-time data, customizable alerts, and risk management features.

Market Sentiment Analysis:

Use the tool to gauge market sentiment by analyzing call and put option data.

Identify areas of high open interest to pinpoint potential support and resistance levels.

Risk Management:

Assess risk by calculating options Greeks like delta, gamma, and theta.

Determine potential profit and loss scenarios before executing trades.

Strategy Development:

Develop and test trading strategies using historical data and simulation features.

Optimize your strategies for different market conditions.

Technical Analysis:

Utilize advanced charting tools and technical indicators for in-depth analysis.

Identify patterns and trends within the option chain data.

Real-Time Monitoring:

Stay updated with real-time data to adapt to changing market conditions.

Set custom alerts for specific price levels or market changes.

Step-by-Step Guide to Analyzing Nifty Option Chain

Analyzing the Nifty Option Chain is essential for traders seeking to make informed decisions in the Indian stock market. Here’s a simple step-by-step guide:

Select Your Tool: Choose a reliable Option Chain Analysis Tool for Nifty options, ensuring it offers real-time data and customizable features.

Understand the Basics: Familiarize yourself with terms like call options, put options, strike prices, open interest, and volume.

Choose Your Date: Specify the expiration date you want to analyze within the Nifty Option Chain.

Examine Call and Put Data: Review the data for call and put options, paying attention to strike prices and open interest.

Identify Support and Resistance: Look for areas with significant open interest to determine potential support and resistance levels.

Analyze Volume: Assess the volume of options traded at different strike prices to gauge market sentiment.

Advanced Techniques in Option Chain Data Analysis

Taking your option chain data analysis to the next level requires advanced techniques. Here’s how to do it:

Implied Volatility Skew: Analyze variations in implied volatility across different strike prices and expiration dates.

Straddle and Strangle Analysis: Evaluate the cost and potential returns of straddle and strangle strategies.

Option Spreads: Explore complex option spreads like iron condors, butterflies, and calendar spreads for enhanced risk management.

Option Chain Visualization: Use advanced visualization tools to gain deeper insights into option chain data.

IV Rank and Percentiles: Calculate IV rank and percentiles to assess the relative value of implied volatility.

Correlation Analysis: Analyze the correlation between different options and underlying assets for diversified trading strategies.

Advanced Options Greeks: Dive into advanced options Greeks like vega and rho to fine-tune your risk management.

Scenario Analysis: Conduct scenario analysis to understand how changes in market conditions affect your options positions.

The Role of Option Chain Analysis in Effective Trading Strategies

Option Chain Analysis plays a pivotal role in crafting effective trading strategies in the options market. Here’s how it contributes to your success:

1. Market Insight:

Option Chain Analysis provides critical insights into market sentiment and potential price movements, helping you anticipate market trends.

2. Risk Assessment:

By evaluating options Greeks such as delta, gamma, and theta, you can assess and manage risk effectively, ensuring your strategies align with your risk tolerance.

3. Strategy Selection:

Option Chain Analysis guides you in choosing the most suitable options trading strategies based on the market’s current conditions and your objectives.

4. Timing Trades:

It helps you identify entry and exit points by analyzing strike prices, open interest, and volume, allowing for well-timed trades.

5. Diversification:

Analyzing various options contracts and strategies enables you to diversify your portfolio, reducing overall risk.

6. Flexibility:

Option Chain Analysis provides the flexibility to adapt your strategies to evolving market conditions, ensuring you stay agile.

7. Maximizing Returns:

Leveraging the insights gained from option chain data, you can maximize your returns and minimize losses.

8. Risk Management:

The analysis enables you to set stop-loss orders and implement hedging strategies, safeguarding your capital.

Incorporating Option Chain Analysis into your trading strategies empowers you to make informed decisions, reduce uncertainty, and enhance your overall trading success. It’s an indispensable tool for traders seeking to navigate the complex world of options trading effectively.

Integrating Option Chain Analysis into Your Trading Plan

To elevate your trading strategy, consider these key steps for seamless integration of Option Chain Analysis:

Objective Alignment: Ensure your analysis aligns with your trading goals, whether it’s income generation, capital preservation, or aggressive growth.

Data Integration: Make real-time option chain data an integral part of your decision-making process.

Risk Management: Utilize options Greeks and open interest analysis to manage risk effectively and set stop-loss orders.

Strategic Adaptation: Adjust your strategies based on the insights derived from option chain analysis to stay responsive to market shifts.

Continuous Learning: Stay updated with new tools, techniques, and market developments to refine your integration over time.

How Option Chain Analysis Can Predict Market Movements

Option Chain Analysis is a potent tool for predicting market movements by:

Market Sentiment: Gauging sentiment by analyzing call and put options’ open interest and volume can indicate the market’s direction.

Support and Resistance: Identifying significant open interest levels often corresponds to support and resistance, helping predict price levels where trends may reverse.

Options Greeks: Changes in options Greeks like delta and gamma can provide clues about potential market shifts.

Implied Volatility: Tracking changes in implied volatility can signal upcoming market volatility or stability.

Large Trades: Monitoring large or unusual option trades can offer insights into institutional or smart money positioning.

Exploring Free and Premium Option Chain Analysis Websites and Apps

Option Chain Analysis is a vital component of modern trading, offering insights into market dynamics. Whether you prefer free resources or are willing to invest in premium tools, there are options to suit every trader’s needs:

Free Websites and Apps:

NSE India Website: The National Stock Exchange of India provides a free option chain analysis tool with a wealth of information.

MoneyControl: A popular financial website that offers free option chain data, along with other market-related information.

Investing.com: Provides free option chain analysis tools with real-time data, making it suitable for traders on a budget.

Yahoo Finance: Offers free option chain data, including strike prices, open interest, and volume.

Premium Websites and Apps:

Option Action: Known for its premium features, real-time data, and advanced analysis tools, it’s a favorite among professional traders.

Investar: A premium option chain analysis software with a wide range of technical indicators and customization options.

TickerPlant: Offers premium option chain data with a focus on real-time analytics and advanced charting.

Sensibull: A premium options trading platform with advanced option chain analysis features and strategy builders.

When deciding between free and premium options, consider your budget, trading goals, and the features you need. Both free and premium option chain analysis resources can enhance your trading strategies and decision-making.

Best Websites for In-depth Option Chain Analysis

When it comes to in-depth Option Chain Analysis, these websites offer valuable tools and data:

NSE India Website: The National Stock Exchange of India provides a comprehensive option chain analysis tool, ideal for Indian traders.

MoneyControl: A popular financial website with detailed option chain data and additional market-related insights.

Investing.com: Offers a user-friendly platform with real-time option chain data and customizable features.

Yahoo Finance: Provides a range of option chain data, including strike prices, open interest, and volume, accessible to traders worldwide.

These websites empower traders with the information needed to make informed decisions, analyze market sentiment, and develop effective trading strategies. Whether you’re a novice or an experienced trader, these platforms are valuable resources for in-depth option chain analysis.

Comparing the Top Apps for Option Chain Analysis on the Go

When it comes to on-the-go Option Chain Analysis, these apps offer convenience and functionality:

OptionAction: Known for its real-time data and user-friendly interface, this app is a favorite for traders seeking mobility.

NSE Mobile: The official mobile app of the National Stock Exchange of India provides access to option chain data and market updates on the fly.

MoneyControl: With its mobile app, MoneyControl offers users the ability to track option chain data and stay informed about market trends.

Investing.com: The mobile app version of this platform delivers real-time option chain information and customizable features to traders on their smartphones.

Maximize Your Profits with Expert Calls!

Access expert stock calls for quick profits. Trade with confidence through BankNifty.today’s insights!

FAQ

What is the best Option Chain Analysis Software for 2024?

Benefits for Traders:

Option chain analysis provides traders with valuable insights into the options market, allowing them to make more informed trading decisions.

– It helps traders identify potential support and resistance levels for the underlying asset.

– It aids in assessing market sentiment and understanding the potential price movements of the underlying asset.

– It can be used for hedging strategies and managing risk in a portfolio.

How does Option Chain Analysis Software benefit traders?

Key Features of Top Option Chain Analysis Software:

– Real-time data: Access to up-to-the-minute option chain data.

– Visualization tools: Interactive charts and graphs to analyze option data.

– Advanced filters: Customizable filters to search for specific options based on criteria like strike price, expiration date, volume, etc.

– Historical data: Access to historical option chain data for backtesting strategies.

– Greeks calculations: Tools to calculate and understand options’ Greeks (Delta, Gamma, Theta, Vega).

– Probability analysis: Tools for assessing the probability of option expirations in the money.

How do free and paid Option Chain Analysis tools compare?

Free vs. Paid Option Chain Analysis Tools:

– Free tools may offer basic option chain data but may lack advanced features and real-time data.

– Paid tools typically provide more comprehensive data, advanced analytics, and real-time updates.

What are the innovative features of Nifty Option Chain Analysis Software?

Innovative Features of Nifty Option Chain Analysis Software:

– Nifty-specific analysis tools, such as volatility skew analysis and Nifty-specific Greeks calculations.

– Integration with relevant news and events affecting Nifty options.

How can Option Chain Analysis predict market movements?

Predicting Market Movements:

– Option chain analysis alone cannot predict market movements with certainty. It helps traders assess potential price ranges and market sentiment.

– Combining option chain analysis with technical and fundamental analysis can improve predictive abilities.

What is the role of Option Chain Analysis in effective trading strategies?

Role in Trading Strategies:

– Option chain analysis helps traders identify potential entry and exit points.

– It is crucial for constructing options strategies like straddles, strangles, spreads, and condors.

Can Option Chain Analysis be used for risk management?

Risk Management:

– Option chain analysis aids in assessing and managing risk by evaluating the impact of options positions on a portfolio.

How can I integrate Option Chain Analysis into my trading plan?

Integration into Trading Plan:

– Incorporate option chain analysis as a complementary tool in your trading plan, alongside other forms of analysis.

– Define specific criteria and strategies based on option chain data.

What are the best websites for in-depth Option Chain Analysis?

Websites for Option Chain Analysis:

– Websites like Yahoo Finance, Bloomberg, and options-specific platforms like Tastyworks, Thinkorswim, and Interactive Brokers offer option chain analysis tools.

Summing Up: How Option Chain Analysis Software Transforms Trading and Market Strategy

Option Chain Analysis Software is a game-changer in the world of trading, providing invaluable insights and transforming market strategies. Let’s recap the key takeaways:

Informed Decision-Making: Option Chain Analysis empowers traders with data-driven insights, enabling them to make informed decisions in the options market.

Risk Management: Traders can assess and manage risk effectively by utilizing options Greeks and other risk assessment tools.

Strategy Optimization: The software facilitates the development and optimization of trading strategies, aligning them with market conditions.

Real-time Data: Access to real-time market data keeps traders updated with the latest information, allowing for quick responses to market changes.

Diversification: By analyzing various options contracts and strategies, traders can diversify their portfolios, reducing overall risk.

Agility: Option Chain Analysis Software offers flexibility, allowing traders to adapt to evolving market conditions and stay agile.

Maximizing Returns: Leveraging the insights gained from option chain data, traders can maximize returns and minimize losses.

In conclusion, Option Chain Analysis Software is a must-have tool for traders seeking to navigate the complexities of options trading effectively. It enhances market understanding, supports risk management, and ultimately contributes to more successful trading strategies. Embracing this technology can make a significant difference in your trading journey.

Do you want

more profit?

Want to make money like the pros? 📈 We show you the easy way with tips everyone can use. Ready to start? 👍

Curious About Us?

At BankNifty.today, trading intelligence becomes your superpower. We demystify the stock market, making top-notch trading strategies accessible for everyone. Our platform is where beginners turn into savvy investors. Ready to take control of your financial destiny with us?

Get our Trading Tips for Free! 🎉

Sign up for our no-cost trial and see your trading improve.

Join our Telegram now!