Get easy-to-follow, expert stock market tips that can help you earn more.

📈 Click here for smart, reliable advice! ✨

Premium Decay Analysis: Decoding Options Trading in 2024

SHARE

In the ever-evolving landscape of options trading in 2024, understanding the concept of premium decay is paramount. Premium decay, also known as time decay, is a fundamental aspect of options trading that can significantly impact your trading strategies and overall profitability. In this article, we will delve into the intricacies of premium decay and its relevance in the current options trading environment.

Here are some key points to consider:

What is Premium Decay?: Premium decay refers to the gradual reduction in the value of an option as it approaches its expiration date. This decline in value is primarily driven by the diminishing time left for the option to make a favorable move.

Theta: The Time Decay Factor: Theta, one of the Greek letters used in options trading, represents the rate at which an option loses its value due to the passage of time. Understanding theta is crucial for traders as it helps them assess the impact of time decay on their positions.

Bank Nifty Options: Bank Nifty options are a popular choice among traders, offering unique opportunities and challenges. Analyzing premium decay in Bank Nifty options requires a deep understanding of market dynamics and the ability to implement effective strategies.

Strategies to Mitigate Premium Decay: Traders can employ various strategies to navigate premium decay successfully. These strategies may include covered calls, calendar spreads, and iron condors, which aim to offset the negative effects of time decay.

What is Premium Decay and How Does It Affect Options?

Premium decay, also known as time decay, is a fundamental concept in the world of options trading. It refers to the gradual erosion of an option’s value as it approaches its expiration date. Understanding premium decay is crucial for options traders, as it can significantly impact their trading strategies and outcomes. Here’s a breakdown of what premium decay is and how it affects options:

The Basics: Premium decay occurs because options have a limited lifespan. As time passes, the window of opportunity for the underlying asset’s price to move in a favorable direction narrows.

The Role of Theta: Theta, one of the Greek letters used to measure option sensitivity, quantifies the rate at which an option loses value due to time decay. The higher the theta, the faster the premium erodes.

Options Pricing: Premium decay is a key component of options pricing. It is one of the factors that make options different from stocks or other financial instruments. Traders must factor in premium decay when assessing the potential profitability of their options positions.

Impact on Strategies: Premium decay affects different options trading strategies differently. Strategies that involve selling options, like covered calls or credit spreads, can benefit from premium decay as time passes. Conversely, strategies that involve buying options, like long calls or puts, may face challenges due to time decay.

The Mechanics Behind Premium Decay in Options Trading

Time Sensitivity: Premium decay, often referred to as time decay, stems from the finite lifespan of options contracts.

Theta Value: Theta, a Greek letter, quantifies the rate at which an option’s value diminishes due to time decay. Higher theta equates to faster premium erosion.

Daily Erosion: Options lose value daily as they move closer to their expiration date, with the rate of decay accelerating as expiration approaches.

Intrinsic vs. Extrinsic Value: Options consist of intrinsic (real) and extrinsic (time) value. Premium decay mainly impacts the extrinsic portion.

Impact on Strategies: Premium decay plays a pivotal role in strategy selection, favoring strategies that involve selling options (credit spreads) over buying (long calls/puts).

Understanding the mechanics behind premium decay is essential for traders, allowing them to harness its dynamics and make informed decisions in the options market.

Maximize Your Profits with Expert Calls!

Access expert stock calls for quick profits. Trade with confidence through BankNifty.today’s insights!

Analyzing Premium Decay in Nifty and Bank Nifty Options

Options trading, especially in indices like Nifty and Bank Nifty, involves a nuanced understanding of premium decay. Analyzing premium decay in these indices is critical for traders aiming to maximize their profits and manage risks effectively. Here’s a closer look at how premium decay impacts Nifty and Bank Nifty options:

Market Dynamics: Nifty and Bank Nifty are closely tied to India’s financial markets, making them popular choices for options traders. Understanding market dynamics is the first step in analyzing premium decay in these indices.

Volatility: Volatility in Nifty and Bank Nifty can have a substantial impact on premium decay. Higher volatility often leads to higher premiums, which can decay rapidly if the market stabilizes.

Strategies: Successful analysis of premium decay in Nifty and Bank Nifty options requires the implementation of sound strategies. Traders often use delta-neutral strategies and volatility analysis to mitigate the effects of time decay.

Earnings Announcements: Earnings announcements and other economic events can introduce rapid changes in premiums. Analyzing the timing of these events is crucial for options traders.

Risk Management: Effective premium decay analysis is not just about profit potential but also risk management. Traders must assess the potential loss due to premium decay and implement stop-loss orders when necessary.

Bank Nifty Premium Decay: Strategies for Traders

Covered Calls: Sell call options while holding the underlying Bank Nifty shares. Premium collected helps offset premium decay.

Iron Condors: Simultaneously sell an out-of-the-money call and put option on Bank Nifty. Benefit from time decay if Bank Nifty remains range-bound.

Calendar Spreads: Buy and sell options with different expiration dates on Bank Nifty. Capture premium decay as the shorter-term option erodes faster.

Credit Spreads: Sell an option and buy another with the same expiration but different strike prices. Premium from the sold option helps counteract decay.

Continuous Monitoring: Stay vigilant. Premium decay strategies require active management to adjust positions as market conditions change.

Navigating Nifty Option Premium Decay for Maximum Profit

Delta-Neutral Strategies: Employ strategies like straddles or strangles to neutralize the impact of premium decay while betting on significant market movements.

Volatility Analysis: Monitor implied volatility levels in Nifty options. High volatility can boost premiums, while low volatility may signal reduced decay.

Rolling Options: Extend your options’ expiration dates to avoid rapid premium decay. This can be done by rolling your position forward.

Earnings Calendar: Be mindful of corporate earnings releases and other economic events. Premiums can fluctuate significantly during these periods.

Stop-Loss Orders: Implement stop-loss orders to limit potential losses due to adverse premium decay.

Mastering premium decay analysis in Nifty options can empower traders to make informed decisions and optimize their profit potential while managing risk effectively.

Premium Decay Calculators and Charts: Essential Tools for Traders

In the world of options trading, information is power. Premium decay calculators and charts are indispensable tools that provide traders with valuable insights into the dynamics of options premiums as they evolve over time. These tools are crucial for making informed decisions and maximizing profitability. Here’s why premium decay calculators and charts are essential for traders:

Real-Time Data: Premium decay calculators offer real-time data on how an option’s premium erodes as it approaches expiration. This information is invaluable for assessing the potential profitability of a trade.

Scenario Analysis: Traders can use premium decay calculators to run scenario analyses. They can input different variables such as time, implied volatility, and underlying asset price to understand how these factors affect premium decay.

Strategy Optimization: Premium decay charts allow traders to visualize how different options strategies may perform over time. This helps in optimizing strategy selection and timing.

Risk Management: By tracking premium decay, traders can set appropriate stop-loss levels to limit potential losses due to time decay.

Educational Tool: Premium decay calculators and charts serve as educational tools, helping traders understand the complex relationship between time and option premiums.

In conclusion, premium decay calculators and charts are essential for any serious options trader. They provide real-time insights, aid in scenario analysis, and assist in risk management. With these tools at their disposal, traders can navigate the intricate world of options trading with greater confidence and precision.

Get our Trading Tips for Free! 🎉

Sign up for our no-cost trial and see your trading improve.

Join our Telegram now!

How to Use Premium Decay Calculators Effectively

Input Key Parameters: Start by entering the essential information, such as the option’s strike price, expiration date, current premium, and implied volatility.

Time Sensitivity: Experiment with different time frames to observe how premium decay affects the option’s value as the expiration date draws near.

Implied Volatility: Adjust implied volatility levels to understand how changes in market volatility impact premium decay.

Scenario Analysis: Utilize the calculator for scenario analysis. Assess how premium decay influences various options strategies under different market conditions.

Risk Management: Use the data generated by the calculator to set stop-loss levels and make informed decisions about managing your options positions.

Premium decay calculators are powerful tools, but their effectiveness depends on your ability to input accurate data and interpret the results.

Interpreting Premium Decay Charts for Better Trading Decisions

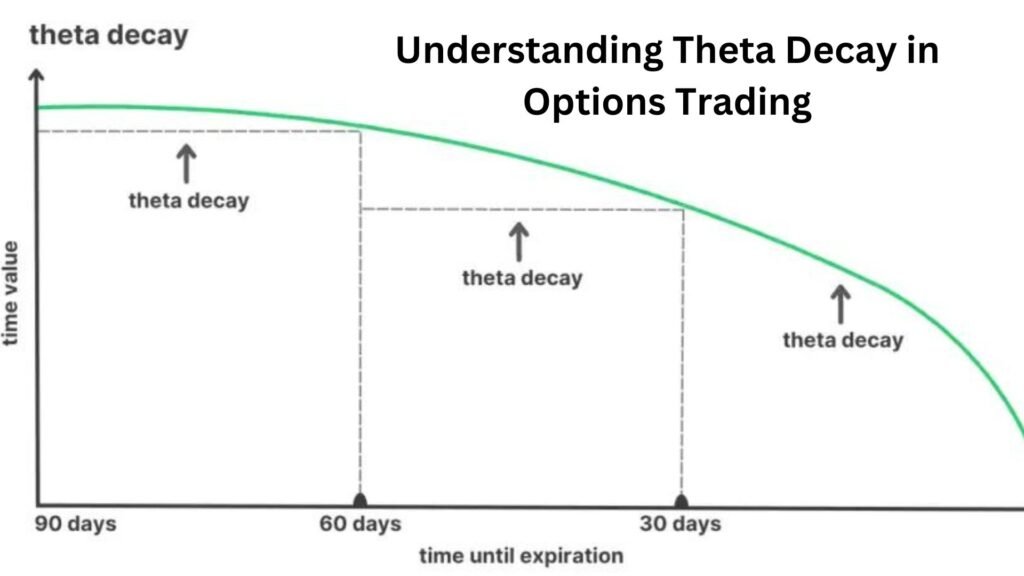

Understanding Time Axis: The horizontal axis on premium decay charts represents time until options expiration. Each point shows how the premium changes over time.

Premium Erosion Rate: Observe the slope of the premium decay curve. Steeper slopes indicate faster premium decay.

Strategy Evaluation: Use charts to compare different options strategies. Visualize how premium decay impacts each strategy and make informed choices.

Implied Volatility: Recognize the impact of implied volatility changes on premium decay. Charts can help you assess how variations in volatility affect your options positions.

Exit Timing: Determine optimal exit points by analyzing when premium decay starts to accelerate. This can aid in maximizing profits and minimizing losses.

Mastering the interpretation of premium decay charts empowers traders to fine-tune their strategies, enhance timing, and make more profitable trading decisions in the complex world of options.

The Impact of Theta on Option Premium Decay

In the realm of options trading, the concept of theta is central when it comes to understanding and managing premium decay. Theta, often referred to as the “time decay factor,” quantifies the rate at which an option’s premium erodes as time progresses. Here, we delve into the significance of theta and its influence on option premium decay.

Understanding Theta: Theta measures the change in an option’s price for each passing day, assuming all other factors remain constant. It’s an essential component of an option’s pricing model, alongside factors like underlying asset price, implied volatility, and interest rates.

The Theta Effect: Theta’s impact on premium decay is straightforward: the higher the theta, the faster an option loses its value over time. This is because options have a limited lifespan, and as they edge closer to their expiration date, the time decay accelerates.

Options Strategies: Traders can use their understanding of theta to strategically select options and construct trading strategies. Some strategies involve selling options with high theta to benefit from their rapid premium decay, while others focus on minimizing theta exposure.

Risk Management: Theta also plays a crucial role in risk management. It helps traders assess the potential loss due to premium decay and set appropriate stop-loss levels.

Dynamic Nature: Theta is not constant; it changes as the time to expiration shortens. Traders must continuously monitor theta values to adapt their strategies and make informed decisions.

Understanding Theta Decay in Options Trading

The Time Decay Factor: Theta, represented by the Greek letter Θ, quantifies the rate at which an option’s value diminishes as time passes.

Intrinsic vs. Extrinsic Value: Theta primarily affects the extrinsic value of an option. Intrinsic value is unaffected by time decay.

Exponential Decay: Theta’s impact is not linear but exponential. As an option’s expiration date approaches, time decay accelerates.

Options Pricing: Theta is a crucial component of options pricing models, such as the Black-Scholes model, and helps determine an option’s premium.

Theta Strategies: Traders can use knowledge of theta to implement strategies. Selling options with high theta can generate income, while buying options with low theta minimizes time decay risk.

Strategies for Managing Theta's Impact on Premium Decay

Option Selling: Sell options to capitalize on premium decay. Strategies like covered calls and credit spreads can generate income through time decay.

Short-Term Options: Opt for shorter expiration periods to minimize exposure to extensive time decay. However, this strategy requires frequent monitoring and adjustments.

Rolling Positions: Extend the life of options contracts by rolling them forward to a later expiration date. This can delay premium decay and offer more time for the underlying asset to move favorably.

Theta-Neutral Strategies: Implement theta-neutral strategies like iron condors, where the positive and negative theta components balance out.

Stay Informed: Keep a watchful eye on implied volatility, as it can impact theta. High volatility can increase time decay, while low volatility may slow it down.

Practical Guides to Premium Decay Analysis

Premium decay analysis is a vital skill for options traders, enabling them to navigate the complex world of options with confidence. Here are practical guides to help traders effectively analyze and manage premium decay:

Understand Theta: Theta, the time decay factor, is at the core of premium decay. Familiarize yourself with how it influences options pricing and premium erosion.

Select Appropriate Options: Choose options with expiration dates and strike prices that align with your trading objectives. Shorter-term options tend to decay faster, while out-of-the-money options have higher theta.

Monitor Implied Volatility: Implied volatility affects premium decay. High implied volatility can accelerate decay, while low volatility may slow it down. Keep an eye on implied volatility levels in your chosen options.

Implement Theta-Neutral Strategies: Utilize strategies like iron condors or calendar spreads to balance positive and negative theta components, mitigating premium decay’s impact.

Set Stop-Loss Orders: Protect your positions by setting stop-loss orders. These can limit potential losses due to adverse premium decay.

Continuous Learning: Stay updated with the latest developments in options trading. Books, courses, and trading communities can provide valuable insights and strategies for premium decay analysis.

Practice with Paper Trading: Before risking real capital, practice premium decay analysis through paper trading. This helps you refine your skills without financial consequences

Using Premium Decay Analysis to Enhance Trading Performance

Strategic Insight: Premium decay analysis provides a deeper understanding of options pricing, allowing traders to make more informed decisions.

Risk Management: Recognizing the impact of time decay helps traders set appropriate stop-loss levels and manage potential losses.

Strategy Selection: Premium decay analysis guides traders in selecting the most suitable options strategies based on their risk tolerance and market outlook.

Maximizing Profits: By mastering premium decay analysis, traders can optimize their entries and exits, potentially increasing profits.

Adaptability: Traders can adapt to changing market conditions by understanding how premium decay influences their positions.

Continuous Improvement: Incorporating premium decay analysis into your trading routine fosters continuous learning and improvement.

Advanced Techniques for Analyzing Premium Decay in Options

Advanced Theta Modeling: Utilize advanced mathematical models to precisely calculate and predict theta decay, considering various market factors.

Sensitivity Analysis: Conduct sensitivity analysis to understand how changes in parameters like implied volatility and interest rates impact premium decay.

Historical Data Analysis: Analyze historical premium decay patterns to identify trends and make data-driven decisions.

Options Greeks Integration: Incorporate options Greeks like delta, gamma, and vega into premium decay analysis for a more comprehensive view of options pricing dynamics.

Machine Learning Algorithms: Employ machine learning algorithms to forecast premium decay and enhance trading strategies.

Volatility Skew Assessment: Study volatility skew to gain insights into premium decay variations across different strike prices.

Maximize Your Profits with Expert Calls!

Access expert stock calls for quick profits. Trade with confidence through BankNifty.today’s insights!

FAQ

What is premium decay in finance?

Premium decay, also known as time decay or theta decay, is a fundamental concept in options trading and finance. It refers to the gradual reduction in the extrinsic value of an option as it approaches its expiration date. Premium decay occurs because as time passes, there is less time for the option to move in a favorable direction, making it less valuable.

How does premium decay affect options trading?

Effect on Options Trading:

Premium decay affects options trading by diminishing the value of options over time. It puts pressure on option buyers since they must overcome this decay to make a profit. Option sellers, on the other hand, benefit from premium decay, as they collect the extrinsic value when they sell options.

Can you explain the concept of time decay and premium decay?

Time decay and premium decay are essentially the same concepts. They both refer to the erosion of an option’s extrinsic value as time passes. Extrinsic value is the portion of an option’s premium that is not tied to its intrinsic value (the difference between the option’s strike price and the underlying asset’s current price).

What causes premium decay in options?

Premium decay occurs due to the diminishing time left until an option’s expiration. As time passes, the probability of the option moving into a profitable position decreases, leading to a decrease in its extrinsic value.

What strategies can be used to minimize premium decay?

To minimize premium decay when trading options, traders can consider strategies like buying longer-dated options, selling shorter-dated options, or employing strategies that benefit from time decay, such as writing covered calls or iron condors.

How do implied volatility and premium decay relate to each other?

Implied volatility (IV) and premium decay are related. Higher IV generally leads to higher extrinsic value and, consequently, slower premium decay. Conversely, lower IV tends to result in faster premium decay.

What are the factors that impact premium decay in stock options?

Several factors affect premium decay in stock options, including time to expiration, implied volatility, interest rates, and the underlying asset’s price movements.

How can I calculate the rate of premium decay for an option?

The rate of premium decay for an option can be estimated using the option’s theta, which is a Greek measure that quantifies the expected change in the option’s price for a one-day decrease in time to expiration. Theta reflects the daily rate of premium decay.

What are some common misconceptions about premium decay?

Some common misconceptions about premium decay include the belief that it only affects options close to expiration or that it is linear over time. In reality, premium decay accelerates as an option nears expiration.

How does time to expiration affect premium decay?

Time to expiration has a significant impact on premium decay. Options with more time left until expiration experience slower premium decay compared to options with shorter timeframes.

Concluding Insights: The Strategic Role of Premium Decay in Options

As we conclude our exploration of premium decay in options trading, it’s evident that understanding and effectively managing this phenomenon is paramount for traders seeking success in the complex world of options. Premium decay, driven by the relentless passage of time, can be both a friend and a foe, depending on how traders harness its dynamics. Here are key takeaways highlighting the strategic role of premium decay:

Risk Management: Recognize that premium decay represents a constant risk in options trading. Traders must implement risk management strategies to protect their capital from erosion.

Profit Potential: While premium decay can erode the value of options, it also presents profit opportunities for traders who understand how to utilize it to their advantage.

Strategy Selection: Premium decay heavily influences the choice of trading strategies. Traders should select strategies that align with their market outlook and risk tolerance, taking premium decay into account.

Continuous Learning: Options trading is dynamic, and premium decay is just one facet of its complexity. Ongoing education and adaptation are essential for long-term success.

Optimization: By mastering premium decay analysis, traders can optimize their trading performance, making well-informed decisions and capitalizing on market opportunities.

In conclusion, premium decay is a fundamental aspect of options trading that cannot be ignored. Traders who embrace its strategic importance, continually refine their skills, and adapt to evolving market conditions are better positioned to thrive in the ever-changing options landscape.

SHARE:

Do you want

more profit?

Want to make money like the pros? 📈 We show you the easy way with tips everyone can use. Ready to start? 👍

Curious About Us?

At BankNifty.today, trading intelligence becomes your superpower. We demystify the stock market, making top-notch trading strategies accessible for everyone. Our platform is where beginners turn into savvy investors. Ready to take control of your financial destiny with us?

Get our Trading Tips for Free! 🎉

Sign up for our no-cost trial and see your trading improve.

Join our Telegram now!